Expose Debt’s Ultimate Weakness to Ensure Its Defeat

“If you know the enemy and know yourself, you need not fear the result of a hundred battles.” -Sun Tzu, The Art Of War

Debt is the enemy…

Its irritating monthly payments devour huge portions of your monthly income, and its interest rate ensures you will be paying down those payments for YEARS to come!!

You have had enough of it. You’re over having no money.

You’re ready to pull yourself up by your bootstraps, pay down your debts, and finally have a monthly income that unequivocally belongs to you!

So what is the #1 way to pay down debt and defeat your enemy?

We’ll get there soon. We first need to study our enemy, know its weaknesses, and devise a strong plan of attack that will only ensure victory!

Your enemy’s profile:

- What is a principle?

- What is a remaining balance?

- How does interest rate work?

- How much of a monthly payment goes towards my principle?

If any of the questions above are elusive to you, read on.

We will find the chink in your debts armor and pinpoint our best plan of attack!

Related Articles:

- How to Stop Living Paycheck to Paycheck

- 5 Budgeting Tips for Beginners to Save Money and Reduce Stress

- The Secret To Becoming Debt Free

Your Debt and Interest Rate Explained:

Example Debt:

- Principle = $10,000

- Remaining balance = $10,000

- Interest rate = 5%

- Minimum monthly payment = $100

Above is a very typical debt with simple numbers for easy, understandable math.

Let’s start with the difference between your principle and your remaining balance.

Your principle is the original loan (or the full strength of your enemy). When you borrowed money, this is the number you agreed upon.

As you make monthly payments (your weapon to defeat debt), a portion of that money goes towards the principle amount which decreases your remaining balance.

Therefore, the remaining balance (or the remaining lifespan of your enemy) is what you currently owe.

In this example, we are starting from the very beginning.

The principle and the remaining balance are the same indicating you have not made any payments towards this debt.

We’re first going to ignore the interest rate completely (wouldn’t that be nice to do in real life).

This will allow us to fully grasp how expensive interest can be, and how it can drastically lengthen the amount of time you’re in debt!

This will also help us to understand what people mean when they say, “money is expensive” or “money is cheap” (we’ll talk about this later).

No interest debt payoff:

- Principle = $10,000

- Remaining balance = $10,000

- Minimum monthly payment = $100/month

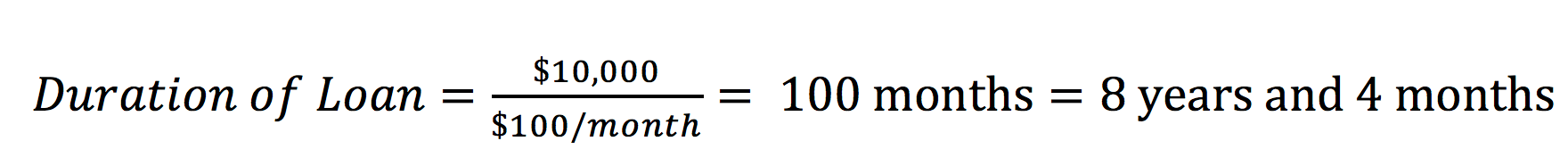

How long will it take to pay off this debt with a $100/month payment?

It will take 8 years and 4 months to pay back $10,000 with a $100/month payment.

Unfortunately, debt becomes a whole lot harder to pay down when it is cladded in armor.

Here comes the interest rate! (Debt’s armor!)

Your lender (the company who lent you your money, car, or house) doesn’t want to lend you money to receive the joy of helping another human being.

No, they want to make money off you and your need for their money.

That’s why when you take on debt, you also receive your very own, personalized interest rate!

Your interest rate is your lender’s monthly paycheck.

Every month when you make your monthly payment, some of it will go to towards paying down your principle, and the remainder goes into your lender’s pocket.

How does your interest rate work?

- Principle = $10,000

- Remaining balance = $10,000

- Interest rate = 5%

- Minimum monthly payment = $100

Interest rate is calculated in an interesting way.

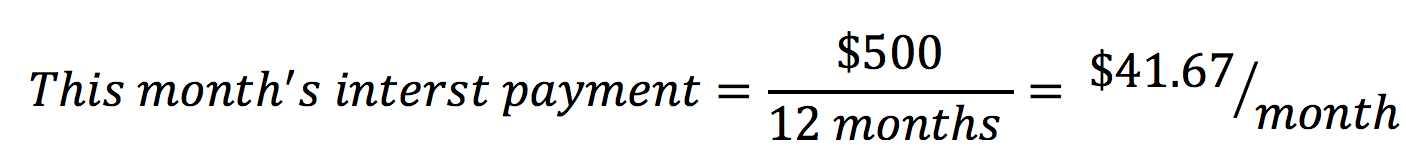

Even though you make monthly payments towards your debt, the interest rate indicates the amount you would spend after 12 months of paying interest.

![]()

With your minimum monthly payment being $100/month, you’re obviously not going to spend $500 dollars in interest every month.

$500 dollars is how much you would spend over the course of a year (kind of, more on this soon).

You must divide that $500 by 12 (12 months in a year) to calculate the current month’s interest payment.

This month, you will pay $41.67 in interest. With a minimum monthly payment of $100, how much of that money would be going towards your principle?

![]()

$58.33 will be used to pay down your principle.

Your money is your weapon!

Every month you make a monthly payment, your enemy suffers another blow to its lifespan (remaining balance).

But do you see how the interest rate acts as its armor? Your $100 attack only did $58.33 worth of damage.

The other $41.67 was deflected by the armor and goes straight into your lender’s pocket.

Here is what your debt looks like after that first payment:

- Principle = $10,000

- Remaining balance = $9,941.67

- Interest paid = $41.67

- Principle paid = $58.33

- Total paid = $100

Let’s quickly go through one more monthly payment so you can have a complete understanding of how your debt works.

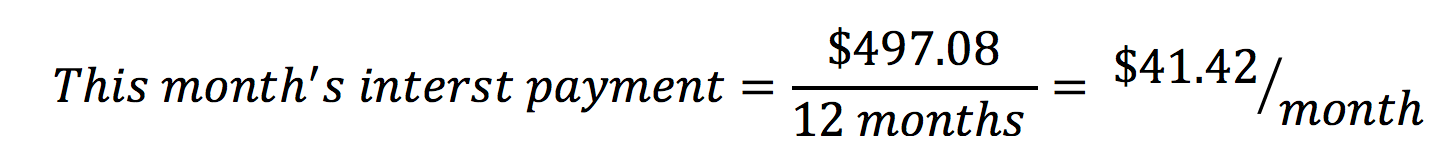

First, let’s calculate what the next month’s interest cost will be (notice the interest is calculated using the remaining balance, not the principle):

![]()

But of course, you need to know how much you are paying in interest this month, not this year.

Since your minimum monthly payment is $100, how much of that money will go towards your principle if $41.42 will be going towards interest?

![]()

Therefore, with this next month’s $100 minimum payment, $58.58 will be used to pay down your principle while $41.42 will be going into your lender’s pocket.

Did you notice how more money went towards the principle ($58.33 => $58.58) and less money went into your lender’s pocket ($41.67 => $41.42)?

Every time you attack your enemy with a monthly payment, its armor grows weaker and your attacks become more deadly.

Here is what your debt looks like after this second round of payments:

- Principle = $10,000

- Remaining balance = $9,883.09

- Interest paid = $83.09

- Principle paid = $116.91

- Total paid = $200

Take a moment to notice how expensive this $10,000 loan is shaping up to be.

It has already cost you $83.09. When people say “money is cheap” or “money is expensive,” they are referring to the interest rate.

If you were to borrow $10,000 with an interest rate of 0.5%, that money would be extremely cheap.

An interest rate of 25% (not uncommon for credit cards) is very expensive money to borrow!

You must pay for the money you borrow, and your interest rate indicates how much.

Let’s see how much it costs to borrow this $10,000 (the amount you pay in interest), and how long it takes to pay down this debt.

- Principle = $10,000

- Remaining balance = $0.00 (It’s completely paid down)

- Interest paid = $2,962.85

- Principle paid = $10,000

- Total paid = $12,962.85

- Total time to pay down this loan = 10 years and 10 months

You will have endured almost 11 years of $100 monthly payment eating at your income and payed your lender $2,962.85 to borrow $10,000.

Compare that to our initial calculation (debt payoff without interest) to see how detrimental, costly and time-consuming interest rates make debt.

Alright, we have fully analyzed our enemy, and we understand how it works.

We know that it uses interest rate as its armor protecting itself from our monthly payments.

But we have also noticed that every time we make a monthly payment, it’s armor weakens and debt becomes more vulnerable to our payments.

Therefore, you need to focus on taking down one debt at a time.

The more money you put towards a single debt, the faster its armor will weaken and the deadlier your monthly payments become.

As soon as one debt is defeated, move on to the next debt, and continue to repeat the process until you are debt free!

With this in mind, let’s take a look at how this $10,000 loan will hold up against a $150/month payment instead of a $100/month payment.

- Principle = $10,000

- Remaining balance = $0.00

- Interest paid = $1,739.60

- Principle paid = 10,000

- Total paid = $11,739.60

- Total time to pay down this loan = 6 years and 6 months

By increasing your monthly payment by only $50 dollars, you’ll get out of debt 4 years sooner and save $1,223.25 in interest payments (money in your pocket)!

Prepare for the (debt payoff) fight!

You wouldn’t go into battle with only the knowledge of how to defeat your enemy.

You have to be prepared to use your weapon (money); equip yourself with the skills needed to ensure victory!

You need to become a master of your money, take full control of your finances, and then will you be able to pay off debt like a true hero!

How do you learn these skills? (AKA the #1 Way to Pay Down Debt)!

Every month, you will set up a plan of action for your money. You will decide where to spend it and how much of it should be spent.

After that…

You can construct a debt pay-down strategy that is right for you, your monthly income, and your lifestyle.

You can do this!

Recall the example where we put an extra $50/month towards the $10,000 debt.

This extra amount wasn’t anything monumental, but that’s ok!

Consistency is what is truly important.

What matters is that the $50/month payment occurs every month incessantly until that debt is paid down!

In our debt example, the entire debt was paid down 4 years quicker and saved us $1,223.25 in interest payments!

Start your debt payoff journey using a method that will guarantee your success. Start budgeting.

Related Articles:

- Stop Plummeting into Credit Card Debt- Learn How to Make Money With Your Card Instead

- How to Stop Living Paycheck to Paycheck Immediately

- 5 Budgeting Tips Beginners Desperately Need to Know

Are you currently trying to pay down debt? We’d love to hear about your journey in the comments below!

Did you enjoy this article? Pin it here!

P.S. Are you following us on Pinterest? Check out and follow our Budgeting Couple Blog “Best Of” board for our best money-saving, frugal living, and budgeting articles!

Excelente articulo.

Thank you so much! Glad you enjoyed it.