7 Habits of People Who Destroy Debt

There’s no secret to paying down debt. If you borrow money, you have to pay it back — that’s just how it works. So what’s the difference between someone who struggles to repay debt and someone who straight up destroys debt? Habits.

Debt destroyers have mastered one important, overarching habit: They find ways to make things easier. Here’s how to apply this super habit to your major money woes and ditch debt in the process.

1. Paying Interest Hurts

When you borrow money, you actually get stuck with two payments: a debt payment + an interest payment. When you pay your monthly debt bill, a big chuck is lost to interest — it does not contribute to paying down your debt. The higher your debt interest rate, the more difficult that debt is to pay down. In the case of credit cards, interest rates can be staggering (often over 15%).

Skip or Minimize Interest with Balance Transfer Cards

People who destroy debt make paying down debt easier. Interest is a problem, so if you could find a way to lower your interest payment, paying back debt would be easier.

Transfer your current credit card debt to a Balance Transfer Credit Card. These cards are designed to help people like you get out of credit card debt? How? They offer lower interest rates, some as low as 0% APY for 12-18 months (your rates will depend on your credit score). How quickly could you get out of debt if you didn’t have to pay interest for an entire year?

Credit Land has compiled the best Balance Transfer Credit Cards. Head over to Credit Land now; find a card that will make it easier to pay back your debt.

2. Paying Bills Sucks

There’s no way around it, paying bills just sucks. But if I could offer some perspective? Think about every dollar you spend as making your life better. Your life is much better because of your mortgage, your utilities, food. Want to know how to enjoy your money? Let every dollar you spend make your life better. Cut every expenses that isn’t making your life better.

Regardless, paying bills still sucks. Especially when money is tight. So how could you make paying bills easier? Could you lower them?

Lower Your Bills Without the Work

Trim cancels unwanted/forgotten subscriptions AND negotiates lower prices on your internet, tv, and phone bills. In short, Trim makes saving on your bills a breeze.

What’s more, their services are free to start. If Trim can’t lower your bills, you don’t pay a dime. But if they are able to lower a bill (and they probably will), you keep 66% of your savings the first year, and 100% of your savings every year after that.

Please note that Trim takes their payment immediately. For example, if Trim saves you $10/month, they will request their 33% fee ($40) right away. But you keep 100% of the savings after that.

Lowering your bills means increased cash flow, which means more money available to put towards your debt.

Trim experts save their users $1498/year on average when they take advantage of all of Trim’s features.

Try Trim. See if they can lower some of your bills.

Related: 8 Ways to Drastically Cut Monthly Expenses

3. Food is Expensive

When you’re trying to eat well, it’s easy to rack up a pricey grocery bill. Just like bills, food is an expense you can’t completely bypass.

Meal planning is a great way to reduce expenses, but keeping things interesting can be a struggle.

For just $5 per month, you can get a weekly meal plan featuring tasty and frugal meals the whole family will enjoy. Try the $5 Meal Plan free for 14 days.

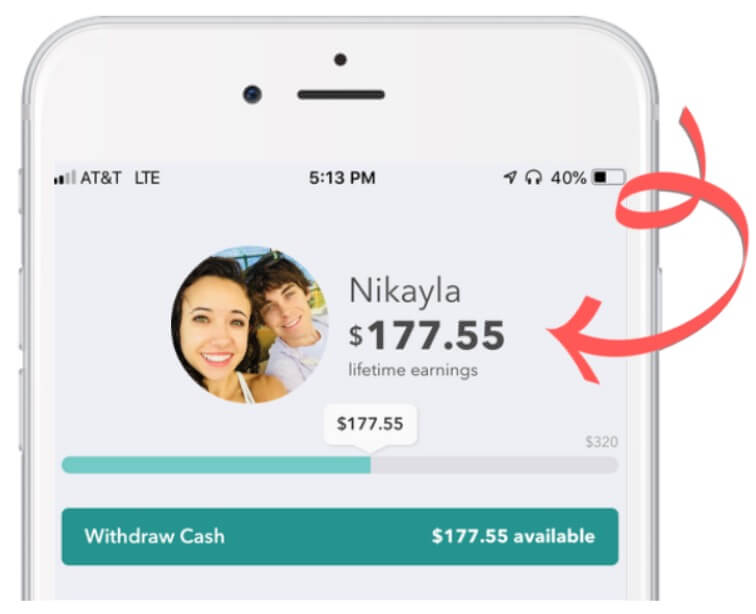

Slash Your Grocery Bill with Ibotta

If you’re not grocery shopping without Ibotta, you’re leaving free money on the table.

Ibotta is a cash back app that makes saving money super easy! Follow these simple steps to earn cash back every time you grocery shop:

- Make your grocery list

- Open the Ibotta app and select the cash back offers that line up with your list

- Take a picture of your receipt and upload it through the app

Cha ching! That’s the sweet sound of money in your pocket.

Want to hear even more ways Ibotta can save you money? Check out our Ibotta explainer video, here!

Related: Ibotta App Review: Is Ibotta Legitimate?

4. Budgeting is a Pain

Budgeting is the #1 tool for taking control of your finances. Why? A budget helps you keep your income over your expenses. When you can spend less than you earn, your money grows. Nothing helps your money grow faster than a detailed budget. But the truth is, getting started with a budget is hard.

Sure, it’s easy enough to write down your fixed expenses, but tracking your spending and adjusting budget categories? That’s just overwhelming. Even if you have the patience to tackle and stick with a budget, finding the time is a challenge.

Simplify Budgeting with Empower

Empower is a money management app that covers your major financial bases. In about two minutes, you can be up and running with a hands-off budget.

All you do is download the Empower app, connect your bank accounts, and set your spending categories. You can choose from stock categories or create your own. Hint: You’ll want to create some debt-destroying categories.

When transactions roll in, Empower sorts them into your categories and tracks your spending for you. You’ll quickly see how your spending compares to your budget. In fact, you’ll get notifications when you’re close to maxing out a budget.

Try Empower free for 30 days and experience effortless budgeting.

Free Workshop – Join our free Simplify Money Workshop

The *only* way to save money is to spend less than you earn. That means you need to decrease your expenses or increase your income.

We want to help you do both.

Join our FREE Simplify Money Workshop to learn the fundamentals of growing wealth. Because when you can spend less than you earn, your money has no choice but to grow. You will build your savings and pay down debt.

What’s more? We’ve got a bunch of free money-hacks to share with you:

- Hacks to lower your monthly bills

- Hacks to spend less on debt

- Hacks to start investing

- Hacks to increase your income by $20/month (with no extra effort)

This workshop has everything you need to accomplish the cardinal rule of personal finance: keep your income over your expenses.

Join our free 5-day Simplify Money Workshop, and start growing your wealth today.

5. Saving Money is Hard

For most people, saving money doesn’t come naturally. You earn a paycheck, you pay your bills, you live your life. Somehow, that seems to eat up all your funds.

If you aren’t intentional about saving money, it doesn’t happen.

Being intentional means building regular savings into your budget and making sure it happens consistently. Problem is, most people don’t approach savings that way. Instead, they put aside whatever is “left over.” Often, that doesn’t amount to much, because we spend everything.

6. Save Money More Efficiently

There are tons of ways to save money, but some are easier than others. Debt destroyers find the smartest (aka easiest) ways to save. Then they take that savings and use it to pay down their debt fast!

Use these four tools to start saving money on every purchase.

Credit Land Rewards Credit Cards

With a rewards credit card, you earn cash back on every purchase. Use your card for all of your purchases and bills, pay your credit card bill in full once per month, and watch the rewards add up. It doesn’t get much easier than that!

Get some perspective: what if you put every payment on your credit card? Every bill, food, online shopping, everything. How much money do you think you could charge to that credit card every year? Is it $10,000? $20,000? $50,000? Now multiply that number by 2%. That is how much *free money* you will earn every year because you switched to using a credit card.

Head to Credit Land to scope out the best rewards credit cards offering huge cash back.

Pro Tip: You can save more with travel rewards card. Travel cards offer perks such as free checked baggage for the entire family, 2% back on flights, priority boarding, one free round-trip plane ticket every year, and discounted lounge access. If you fly only once/year, an airline miles card will save you hundreds. (Btw, miles are the same as points. Generally, 1 point/mile = $0.01)

Check out Credit Land’s favorite Travel Rewards Cards. Grab the card for the airline you travel with most.

Wikibuy

When it comes to shopping online, Wikibuy is a money-saving powerhouse. The free browser extension compares prices across many online retailers (including Amazon) to help you find you a great deal. What’s more, Wikibuy give you loyalty credits when you shop at their partner retailers (loyalty credits can be redeemed for free gift cards to Amazon, Walmart.com, and thousands of other retailers).

But my favorite feature? It finds you coupons codes that work — and it does it in an instant. No more falling down a rabbit hole Googling coupon codes only to waste 30 minutes trying a bunch that aren’t even valid.

Start saving time and money — get the Wikibuy browser extension for free.

Coin Out

Coin out pays cash back on all in store purchases and any online purchases made at partner retailers. To earn on in store purchases, simply scan your receipt. For online shopping, launch partner retailer sites through the Coin Out app. That’s it!

Coin Out pays you real cash, direct to your PayPal account. Ready to get started? Download the free Coin Out app now.

Pro Tip: If you are scanning receipts for any other app (like Ibotta, hint, hint), be sure to add Coin Out to the mix.

Dosh

Want to earn money without really doing anything? You need the Dosh app. Download the free app and link your debit and credit cards. When you shop at any of Dosh’s thousands of retail partners, you’ll automatically earn cash back. You can literally forget about the app until you want to cash out. Dead simple.

Download the Dosh app for an effort-free way to save money today.

7. Simplify

No matter what you want to improve in your life, the key is to simplify the process. If you want to eat healthier, it doesn’t make sense to overhaul your whole diet — it’s too hard. Instead, try reducing one vice, like sugar. If you want to get in shape, walking to work is easier than starting a lifting and running regimen.

It’s the same with your finances. When you master the habit of making things easier and more efficient, you’re more likely to be successful. That’s because, well, it’s easy. And because you’re not wasting time, you’re more likely to discover other innovative ways to make and save money. Debt doesn’t stand a chance!

When you get good at this, you might even find a way to optimize your habits so you crush two goals at once. Ideas? Start an active side hustle like mowing lawns or walking dogs. The possibilities are endless!

Save More Money! Read these next…

- 9 Things I Stopped Buying to Save Money

- 7 Bad Habits That Are Keeping You Poor

- 9 Essential Dave Ramsey Tips You Need to Try!

Want to save these habits for later? Click here to pin this post!

Be sure to follow us on Pinterest for more money-saving life hacks!

*Capital One Shopping compensates us when you get the Capital One Shopping extension using the links we provided*