7 Personal Finance Tips That Will Make You Rich

Tired of seeing less-talented people having more money than you? Flip the script and put more money in your pocket when you become mindful of your money. The more in-the-know you are with your money, the more you can guide it to grow.

Change Your Mindset, Change Your Money

Below you will discover 15 hacks on how to get rich. They work each and every time they are tried. Imagine what kind of life you can live with a little willpower and determination. Ready? Let’s go!

1. A Richer Life Starts with a Saving

Where do you begin? The richer life starts with you putting money in the bank. Try this: transfer 10% of your freshly deposited paycheck into your savings account before any of your usual spending. This money-saving trick prioritizes your emergency fund before all other expenses. When building your savings becomes your money’s priority, you’ll start seeing real results.

Jump Start Your Savings with a High-APY Savings Account

Not all savings accounts are created equal, so be careful where you open an account. The average annual percentage yield for savings accounts is a pathetic 0.08%.

CIT Bank’s Savings Builder consistently pays 10X more than the national average. Open an account with $100, directly deposit only $100 into savings every month, and you will be eligible to receive CIT’s Savings Builder unrivaled interest rates (see CIT’s live banner below for the current interest rate)

Interest is free money the bank pays you on your deposits. Open a CIT Savings Builder account because you will literally build your emergency fund faster.

- Related: What’s an Overdraft Fee? Get Bank Fees Waived

- Related: Best Free Checking Accounts: Top 3 With No Fee

How to Live on 90% (Hacks To Make It Happen)

When you spend less than you earn (save 10% first and live on the remaining 90%), you aren’t living paycheck-to-paycheck. Your money will grow every month. But when expenses are tight, living on 90% can be tough. Here are a few ways to cut expenses painlessly each month so that you can live comfortably on 90%.

Pro tip: Shoot for living on 80% of your income (save 20%) if you can. It’s a practice recommend by Senator Elizabeth Warren, and it will put you on a rocket set towards the rich life.

2. Fill Up Your Stomach, Not Your Cart

When you shop hungry, every item you see looks good. Don’t impulsively throw those $5 snacks into your cart. Eat a good meal before you shop for groceries and write what you need on a list. Then, watch how easy you can stick to buying only the items on your list when you don’t crave food. Keep unnecessary foods, snacks and drinks out of your cart and save.

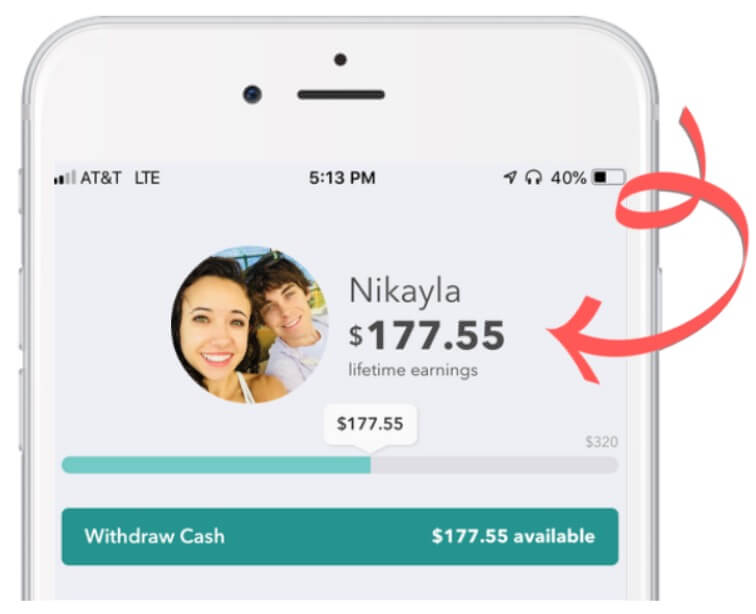

Your Ibotta Earnings Will Start at $20, Then the Sky’s the Limit

Ibotta, the No. 1 grocery app, saves you money on every trip to your local grocery store. Go through Ibotta’s offers and store these digital coupons on your phone. The average Ibotta shopper saves $5 a trip. At $5 a week, you’re talking $250 a year.

Get the free Ibotta app here and make sure you grab your $20 welcome bonus when you use our link.

Want to hear even more ways Ibotta can save you money? Check out our Ibotta explainer video, here!

Download the Free Ibotta App and get this $20 Welcome Bonus just for trying it out!

- Related: 15 Tips to Save Money On Groceries

- Related: Ibotta App Review: Is Ibotta Legitimate?

3. Watch Your Money

Be intentional with your spending. Know where your money is going at all times. If you’re not actively monitoring your money, it will work against you.

Grab your husband, open up your bank statement, and list out your expenses. Create a financial plan that allows you to live on 90% of your income. Start to really live by creating an action plan for your money (aka a budget) so you can finally get ahead.

Give Your Children the Best Chance to be Financially Stable with Greenlight

Do you want your children to avoid the financial pitfalls you faced? There’s a way you can teach them to spend appropriately, save intentionally, and give generously with Greenlight, the debit card for kids and teens. Greenlight lets you teach your children a proper money mindset, and all the while you are in control of how much money your kids can access, along with how and where they can spend their money.

With spending limits you set with the Greenlight app, your children will learn how to best use their money. Should they spend their money on candy or save for that Xbox?

Empower your children to make smart decisions with their money with a Greenlight debit card for kids (you can have up to five cards for one low, monthly fee). Sign up for Greenlight today and get your first month free.

Free Workshop – Join our free Simplify Money Workshop

The *only* way to save money is to spend less than you earn. That means you need to decrease your expenses or increase your income.

We want to help you do both.

Join our FREE Simplify Money Workshop to learn the fundamentals of growing wealth. Because when you can spend less than you earn, your money has no choice but to grow. You will build your savings and pay down debt.

What’s more? We’ve got a bunch of free money-hacks to share with you:

- Hacks to lower your monthly bills

- Hacks to spend less on debt

- Hacks to start investing

- Hacks to increase your income by $20/month (with no extra effort)

This workshop has everything you need to accomplish the cardinal rule of personal finance: keep your income over your expenses.

Join our free 5-day Simplify Money Workshop, and start growing your wealth today.

4. Earn Automatic Cash Back

The free Dosh app will turn any linked payment card (debit or credit) into something like a cash back rewards card. Swipe your linked card at Dosh’s partner retailers (like Walmart.com), and Dosh will put money into your wallet for you to redeem for free gift cards.

Download the free Dosh app (use the promo code BUDGETINGCOUPLE to grab yourself a $5 Welcome Bonus)

Credit Cards = Free Rewards

Shop with a rewards credit card (pay it off every month), and everything you buy earns free cash back. You can easily earn 1-2% cash back (or more) on every purchase with a rewards card.

Pro tip: save your points to pay off your statement balance. It takes time (about 2 years), but it feels great to pay off a full month’s credit card bill (a full month’s worth of expenses!) using free money.

Visit Credit Land to find a rewards card that suits your needs. Because spending money becomes more fun knowing you’re always collecting free money on every purchase!

5. You’re Already Subscribed! Why Aren’t You Saving?

You’re an Amazon Prime Member. So why haven’t you set up your Amazon Subscribe & Save? The S&S store can save you up to 15% on your scheduled orders. Subscribe to toilet paper, deodorant, tampons, body wash, hand soap, tooth paste, floss, dog food, protein powder, coffee…

When you subscribe to 5 items, you get 15% off your entire order. And you already have Amazon Prime. Start using this service!

But if you’re not a Prime Member yet, you should be. Sign up for Amazon’s Subscribe & Save program on essentials you need each month and save up to 15% (more money for you to save).

Wikibuy Helps You Save Even More at Amazon

Wikibuy from Capital One is a free service that helps you spend less when you shop Amazon. When you check out online, it will search for active coupon or promo codes to help you save even more money.

Grab Wikibuy’s extremely intelligent browser extension (it’s free) to save on Amazon orders with coupon codes, and stack, stack, stack those savings with Rakuten Rebates.

- Related: Get Free Amazon Gift Cards Fast: 20+ Lazy Ways

- Related: Save Money With Wikibuy: Is it Legit and Safe?

6. Time To Knock Down Debt

After you have built up a nice emergency fund with 3 to 6 months of expenses, it’s time to aggressively pay down your debt. Take the 10%-20% you had been using to build your emergency fund and put all of it toward debt. Keep paying the same amount toward your debt every month, and start with your smallest debts first.

0% Interest On Debt

Do whatever it takes to avoid paying interest. Interest costs a fortune. Check out a 0% interest rate balance transfer card. These credit cards offer 0% interest for 12-18 months (actual rates depend on your credit score). Move your debt to a balance transfer credit card and kick debt’s butt by staying aggressive. You’re paying 0% interest so you’ll be paying down debt faster than ever.

Make great strides on eliminating debt with a zero interest. See which Balance Transfer Card is best for your at Credit Land.

7. Invest in Your Future

Start investing. Don’t let your money sit around not collecting interest. A Roth IRA offers you an ability to invest after-tax money now, and the big benefit is when you withdraw it in your retirement years, the money will be tax-free. While the stock market goes up and down, it generally follows an upward trend.

From Acorns Come Mighty Oaks … and Sound Investments

If you are unsure about how to invest, then you might consider Acorns. Acorns is an app that allows you to invest your “spare change.” For example, when you spend $3.86 on coffee, Acorns will round up the price to $4 and invest the spare 14 cents. What’s more, Acorn members have their spare changed invested by the Nobel Prize Winning economist Harry Markowitz.

If you have struggled to invest money, round up your purchases to the next dollar and invest that spare change with Acorns.

Open up an Acorns account here to start investing

Start Investing Now for a Brighter Future

Did you ever wish you invested early in companies like Apple, Google, Amazon, and Netflix? There is a way you can get in on the ground floor with small, local companies for as little as $100 with Mainvest, a crowdfunding platform for small businesses.

Mainvest is a funding portal that brings together business owners and willing investors. Mainvest vets each business, which increases the likelihood of success. So far, 96% of Mainvest’s investors have been repaid with a return on their investment.

If you want a chance to fund the launch or expansion of the next great coffee shop, bakery, or microbrewery, then start investing with Mainvest. All it takes is $100.

Take Action Today to Create a Wealthier Future Tomorrow

Follow these hacks to start building a richer tomorrow. All the knowledge in the world will do you no good if you fail to act. Choose this day to start making small decisions that will lead to big gains financially over time.

To get the most out of these hacks, combine a number of strategies to maximize your results without additional effort.

Build More Wealth! Read These next…

- 9 High-Paying Side Hustles to Make $200 Extra Per Day

- 7 Bad Habits That Are Keeping You Poor (without realizing it)

- 7 Habits of Women Who Always Have Money

*Capital One Shopping compensates us when you get the Capital One Shopping extension using the links we provided*

Thank you for including our show on your list. As you may know, we’re just having fun with Mom’s bridge club and ourselves. We also adore the other two listeners. They’re fantastic!

Nice post