13 Best Budgeting Tools For Financial Success

Learning how to budget can be tough but necessary for achieving financial success and stability in life. Good budgeting limits your expenses, which can help you prepare a financial future for your retirement among other benefits.

Budgeting is getting easier because of modern software and tools that help keep people disciplined and aware of their spending. Today we’ll be looking at eight of the best budgeting tools for financial success.

Whether you’re budgeting to afford college or simply trying to live within your means, the process never really ends and takes a lot of discipline. Budgeting is like staying on a healthy diet to lose weight or keep fit, which are all conscientious life-long endeavors.

Budgeting tools help you stay on track. We have identified some of the best budgeting tools or apps so you don’t have to go looking for them.

1. Money Patrol – Your Personal Finance Monitor

Money Patrol is an advanced, all-in-one personal finance tool that keeps track of everything–including receipts! Connect and organize all your financial accounts, track investments, and even upload receipts for tax purposes.

In addition to big picture financial reports, Money Patrol tracks your daily inflow and outflow, and then helps you understand your spending patterns and trends. Are you spending an alarming amount of money at Starbucks? Money Patrol will bring it to your attention.

Not only does it provide keen insights into your spending patterns, but it also allows you to create weekly and monthly budgets. Plus, it sends alerts when you are about to make a budget no-no and overspend!

Check out Money Patrol here. Their average user reports a $5K personal finance growth.

2. Pocket Smith – Take Control of Your Financial Life

Financial planning just got a whole lot easier thanks to Pocket Smith.

This budgeting tool has everything you need to track your spending and make sure you’re on track to meet your financial goals…and shape your financial future. Use it on your desktop or iOS/Android device.

Pocket Smith is unique in that it allows you to learn from the past, stay on track in the present, and predict the future. In addition to live bank feeds, a budgeting calendar, and even the ability to manage combined incomes (a plus for couples living together), you can also easily forecast cash flow.

Should you want to, you could project your bank balances up to 30 years in the future!

As if that is not enough reason to love Pocket Smith, it also includes a unique and cool form of financial planning with “What If” scenarios. Want to know “what if” you lost your job? Or “what if” you canceled your cable subscription?

Check out Pocket Smith today and gain control over your financial future.

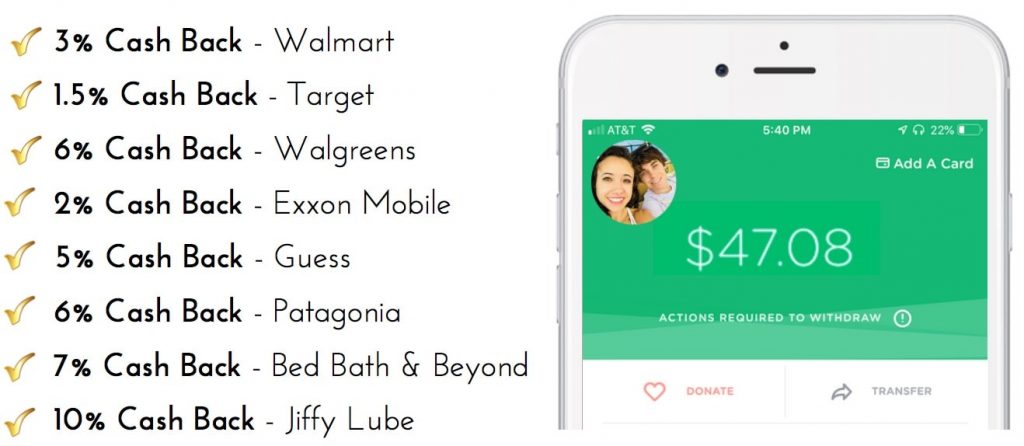

3. Dosh – Free Money, Automatically

What if you got cash back all the time, no matter what card you use, without even thinking about it?

Dosh is an app that helps you get cash back, without any ongoing effort at all. Depending on where you spend your money, you can get up to ten percent back without doing anything extra. Think your 3% savings on gas is a big deal? Think again.

Over time, this cash back each month adds up fast. You’ll be amazed when you check back periodically to find a bundle of bills waiting for you when you open the app.

Oh, and it’s FREE. Download Dosh here, and you will get a free $1 bonus just for linking your credit or debit card to the app. Dosh is available on smartphones both iOS and Android

Also See: Dosh App Review- Is It Safe?

4. Trim – Cut Out the Excess Expenses

Trim is a powerful tool that helps you identify recurring expenses that you may not be using much, and then works with you to get those canceled so you can save more every month.

This is unlike other tools because it isn’t just a finance management platform, but a service that utilizes artificial intelligence (AI) to learn about your habits and actively helps you make better financial decisions. Trim employs an algorithm that is programmed to help you save money and budget better.

In addition, the service includes an automated bill negotiation tool. That means Trim can help you negotiate your bills and cancel unwanted or unused subscriptions. They have a state-of-the-art support team that doesn’t shy away from the personal touch of communicating with you via Messenger and text messages.

Trim is extremely convenient. Using this app is like having a personal assistant or accountant that is actively involved in managing your finances. Start trimming the fat from your monthly expenses by trying Trim today!

Want to lower your bills by $500+ A Month? Check out our “Lower Your Bills Guide” here

5. Personal Capital – Long-Term Planning for Wealth Management

Personal Capital provides you with the whole financial picture–not just the assets it manages.

Whether you need to set up a budget or want to plan for your retirement, Personal Capital makes it easy. Simply connect all your financial accounts including mortgages, loans, checking, credit cards, savings, IRAs, and 401(k)s to see your net worth.

Unlike other budgeting tools, Personal Capital also acts as an online financial advisor that combines robo-advisors with access to actual advisors. You can access many of the Personal Capital’s money management tools totally FREE.

Set up your free Personal Capital account here.

6. Count About – A Web-Based Financial Solution

This web-based personal finance solution allows you to easily manage your finances any time, any place–as long as you have an Internet connection.

Count About allows you to import data from Quicken and Mint and automatically import new transactions in real time. Additionally, you can automatically sync data from your bank, credit cards, and retirement accounts so all you have to do is manage your money.

Count About stands out for many reasons. There is no software to install, the customization options are endless, and it’s also an ideal solution for small business owners.

Its robust reporting is ideal for people who like data and want to customize how they analyze spending and budget better. Not only can you modify categories and labels however you want, but you can also easily export that data to Excel. Just like customization options for reporting, you can create budgets however you like–from splitting transactions into multiple budgeting categories to memorizing certain purchases.

Count About can be used on your home computer and also on iOS/Android apps.

Try Countabout for free for 15 days! If you fall in love with Count About, you can continue using it for as low as $9.99 a year.

7. Charlie – Your New BFF (Best Financial Friend)

Using a combination of artificial intelligence and algorithms, this adorable penguin is the money management friend you never knew you needed!

Charlie helps you reduce your bills by sending you messages when he notices you are paying too much and stops you from paying extra charges when you’re close to overdrawing your account.

Need help budgeting? Simply send Charlie a message telling him your limit for the month, and he’ll track your spending and send you a message when you are cutting it close.

Goal-setters will love having Charlie in their pockets. Simply message Charlie the amount you want to save and by when, and he will break your savings goal into doable chunks.

Another bonus – the app is free! Check out how Charlie can help you better manage your money.

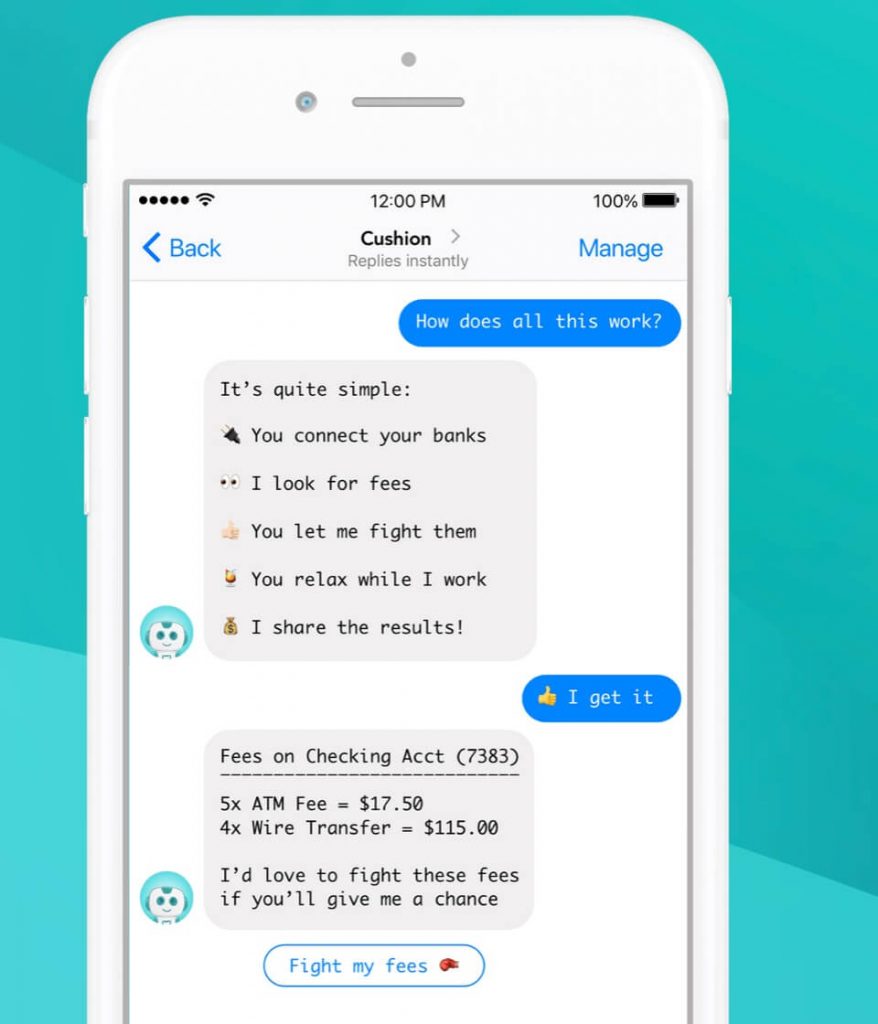

8. Cushion – Your Financial Advocate

Ever thought you needed a financial advisor or advocate between you and your financial institution? Well, this particular tool is not too far off. The Cushion App not only uses artificial intelligence to negotiate transactions but also actively works with your bank to lower or eliminate fees! This includes interest charges for loans.

The Cushion bot, “Fee Fighter”, scans your connected accounts to identify historical fees and interest charges. Then it determines or formulates a plan to negotiate elimination or reduction of fees with your financial institution on your behalf.

Most people don’t have the time or energy to constantly be focused on every fee, bill, or charge made by their bank.

Let Cushion do it for you today!

Related: 11 Best Cash Back Apps for 2020

9. Mint Mobile – Save BIG on Your Phone Bill

This platform is the real deal and just might save you $100+ on your phone bill every month.

Mint Mobile provides a clever way of getting unlimited text and talk time, starting at $15 per month. You don’t have to lose your number and can keep your phone but won’t have to worry about budgeting talk minutes or text ever again. Basically, you get all the benefits of your current phone and phone line, but you pay a LOT less.

Check Mint Mobile out now and use their cost calculator to find out how much you can save!

10. Excel and Google Sheets – Sometimes the Simple Solution is all You Need

Sometimes you can really make something great with a simple spreadsheet. With Microsoft Excel of Google Sheets, you can design your own Personal Financial Statement or use an existing template from someone else to get organized. A financial statement lists your major assets, liabilities, income, and expense. Excel usually includes free pre-built financial statements that you can edit, and there are Google templates you can use as well.

You might also find templates like amortization spreadsheets for tracking loan payments such as real estate investments, car payments, and other personal debt, so you can see how much money and time you could save on your debts by applying additional payment amounts when possible. All you have to do is update your statement regularly and it will calculate your net worth or progress.

Excel is part of the Microsoft Office Suite of products, which bills at about $150. However, you can get it for roughly $70 per year with an Office 365 subscription. Google Sheets is free with any Google Account.

Also See: How to Live on Less Money : 41 Essential Tips

11. Mint – Effortlessly Stay on Top of Your Finances

Mint is a web-based personal finance management program and is free to sign up. Easily link your bank accounts, credit cards, loans, and investments to get started. Mint will help you maintain monthly budgets by monitoring your account balances and spending.

You can categorize transactions, create specific budgets, set up bill payments, and customize notifications. Users can do things like set notifications for unusual charges, create goal targets and request free credit reports.

The most important part of budgeting is to be aware of where your money is going. Mint is the perfect tool to ensure you see where every dollar is going. Get started today!

Related Personal Finance Guides:

- Best High Interest Savings Accounts in 2020

- Best Free Checking Accounts and Online Banks

- How to Pay Off Credit Card Debt Fast

12. Quicken – Every Feature for Your Finances You Could Want

Quicken is one of the best budgeting tools on the market. The platform has a suite of products that can be linked to multiple types of bank, credit card, and investment accounts.

The tool lets you track and manage investments, spending, and bills, along with a host of other useful financial management features. Quicken goes the extra mile by literally providing you with far more features than you’ll ever use. Quicken is certainly a great way to track your money and budget wisely.

If you really want a hands-on and complete way to control and manage your finances, Quicken is an excellent and proven platform. Give it a go today!

13. You Need a Budget (YNAB) – Budgeting with Education

YNAB teaches you how to manage your money and plan ahead. Import your financial transactions, plan for miscellaneous or emergency expenses, and create budgets based on set targets.

YNAB provides a plethora of tutorials on sensible budget practices and drops occasional hints on how to budget better. The app can also generate charts and graphs that help you see the full picture of your financial journey.

They offer a 34-day free trial to get you started. Students who can provide proof of enrollment get a yearlong free trial. Give it a go for the next month, and see if this is the tool for you!

Financial Success Is Easier With Quality Budgeting Tools

Monitoring and managing your finances should be less tasking, and maybe even a little fun! After all, the aforementioned platforms are the best budgeting tools on the market.

With a few taps on your smartphone, iPad or computer, you can easily be on your way to financial success, which is not just valuable but also enjoyable.

Many of the tools mentioned here would ask you to link up your bank accounts, credit cards, and other details. This only enables them to monitor your finances, which is necessary if they are to assist you with budgeting.

So don’t worry about that if you are a bit concerned about the security of your financial accounts. Each tool has its advantages so select the one that will best serve your needs.