Lower My Bills: 7 Ways to Drastically Cut Monthly Expenses

Want to lower your bills?

Don’t waste 45 minutes talking to customer service (i.e. getting transferred from one person to the next) to lower a bill.

There are easier ways.

Check out these time-efficient ways to save hundreds (if not thousands) of dollars a year on your monthly bills.

Are you in?

How to Lower Your Bills

1. Lower Your Wifi Bill

The Trim App is a free service that does all of that bill negotiation stuff for you.

How does it work?

A live representative will phone your service providers and negotiate your bill (we’re talking Wifi, cable, phone, and even medical bills.)

If Trim cannot lower any of your bills, you pay nothing.

The service is free.

More than likely, however, Trim will find a way to lower a bill.

And when they do, you get to keep 66% of your savings the first year, and a 100% of your savings every year after that.

Please note that Trim takes their payment immediately.

For example, if Trim saves you $10/month, they will request their 33% fee ($40) right away.

But you keep 100% of the savings after that.

Download the free Trim App here and get them to lower your bills for you!

Free Workshop – Join our free Simplify Money Workshop

The *only* way to save money is to spend less than you earn. That means you need to decrease your expenses or increase your income.

We want to help you do both.

Join our FREE Simplify Money Workshop to learn the fundamentals of growing wealth. Because when you can spend less than you earn, your money has no choice but to grow. You will build your savings and pay down debt.

What’s more? We’ve got a bunch of free money-hacks to share with you:

- Hacks to lower your monthly bills

- Hacks to spend less on debt

- Hacks to start investing

- Hacks to increase your income by $20/month (with no extra effort)

This workshop has everything you need to accomplish the cardinal rule of personal finance: keep your income over your expenses.

Join our free 5-day Simplify Money Workshop, and start growing your wealth today.

2. Lower Your Grocery Bill

Food is a one of the bigger budget expenses. Check out these tips to help you spend less on food.

- Make a grocery list: Grocery stores want you to make impulse buys (and they strategically display certain foods in certain locations to make that happen). Don’t fall for their trap. Stick to a list and buy only what you need.

- Plan your meals: Know what you are going to prepare and created a shopping list based on that.

- Eat leftovers: When you cook a meal, you SHOULD cook more than you can eat. That way you have 2 or 3 more meals ready to go. This is a huge way to save time and money.

- Use the Ibotta app to get cash back every time you buy groceries

Ibotta

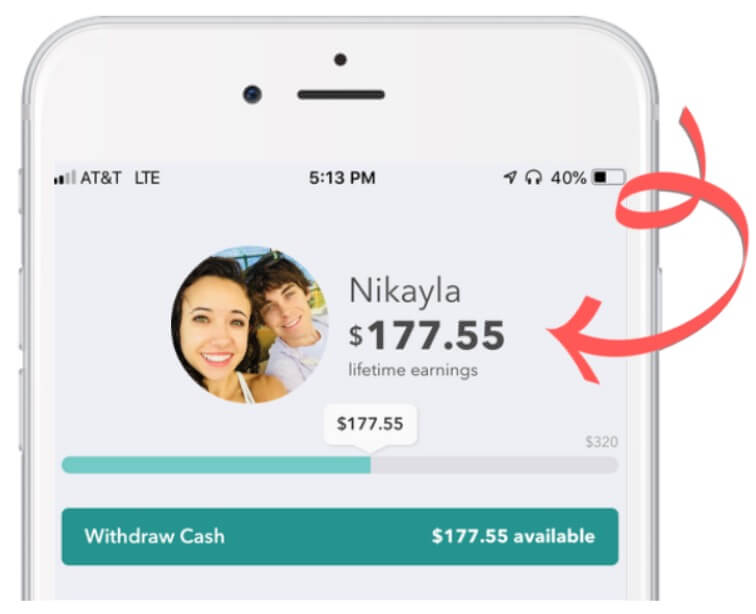

The Ibotta app (iOS and Android) is the leader in “cash-back on groceries.”

The average Ibotta shopper earns $150 in cash back rewards a year for buying items they would normally purchase.

Free money will help lower those grocery bills.

This is the digital way of “clipping” coupons.

Pick out what you want, go to the store, scan the app at checkout, and watch the cash back rewards grow.

Sign up for Ibotta through our exclusive Budgeting Couple link and get a $20 bonus now.

Want to hear even more ways Ibotta can save you money? Check out our Ibotta explainer video, here!

So if you like free money… here’s a free $20 to try out the Ibotta App! (our link works as a $20 referral code)

3. Lower Your Home and Auto Insurance

You’ve seen the commercials: “Call today and you could save X% on your home and auto insurance”

Except there are 40+ different insurance companies saying they can get you the lowest rate.

Do you call all forty companies? I don’t think so.

Insurify is the efficient way to lower your home and auto insurance.

Simply give them your insurance policy information, and they will fetch you a list of top providers offering comparable coverage at lower rates.

Pick the lowest home insurance rate and lowest auto insurance rate, and you can make the switch right then and there.

Head to Insurify.com to switch your home and auto insurance and save hundreds every year.

4. How can I cut my expenses drastically?

You can drastically cut your expenses by doing this one thing:

Eliminating every unnecessary expense.

- Do you really need cable TV when you can subscribe to Netflix and Hulu?

- Do you really need to be subscribed to Netflix and Hulu at the same time?

- Why pay for internet speeds up to 1,000 Mbps when you only need 100 Mbps?

- Quit going out to eat; stay home and prepare your own meals for much less

- Get rid of your high, unlimited cell plans and find a more affordable one (we like AT&T Prepaid).

- Get rid of unused subscription services. Do you really need subscriptions to both Pandora and Spotify? And when’s the last time you listened to an audiobook on your Audible service?

The first step in cutting expenses in not to make drastic cuts.

The first step is to make a bunch of small cuts.

What do you not need?

The steps above will help you realistically save $300 a month or more, which will reduce your bills by $3,600 a year.

Here are more ideas on how to reduce your bills:

- If you have a mortgage, look to refinance it.

- Can you take on a roommate to split some expenses?

- If your family has two cars, consider whether you need both; if not, sell one

- If you have a car, can you drive it less and walk, ride a bike, or carpool more

- If you owe a lot on your vehicle, consider selling it and buying something economical

- Get a cash back rewards credit card. 2% cash back on everything turns into a lot of money.

- Quit eating out (restaurants and fast food)

- Leave the lattes alone

- Lower your grocery bills with Ibotta

Reduce Your Expenses at the Pump, at the Grocery Store, and at Restaurants with Upside

Have you noticed you have less disposable income these days after you fill your tank at the gas station? Not exactly reducing expenses.

High fuel prices might be eating away at your paycheck, but get some cash back with a free app.

Upside, formerly GetUpside, is an app that will get you cash back at gas stations, grocery stores, and nearby restaurants with just a few taps.

When you download the free app and sign up, you will see cash-back discounts and exclusive offers in Upside.

Claim your offer, visit the establishment, complete your transaction, pay with a linked debit or credit card, check-in, and wait for your cash back rewards to roll in.

Upside works at 45,000 locations across the United States.

It started as a cash-back app for gas but has been adding grocery and restaurant chains.

Get paid via PayPal, bank account, or gift card.

Start earning cash back at nearby stores when you install the Upside app.

Use the promo code AFF20 to grab a 20 cents-per-gallon sign-up bonus. Get the free app today.

And here is a list of some more of our favorite cash back apps:

- Ibotta will save you money on food you at the grocery store.

- Ebates/Rakuten will earn you cash back while shopping online (you will love how the browser extension works effortlessly to notify you of cash back opportunities)

- Dosh links to your debit or credit card to earn you automatic cash back as you swipe your card.

Save More Money! Read these next…

Save Money At Your Favorite Stores:

Want to save these tips for later? Click here to pin this post!

Be sure to follow us on Pinterest for more money-saving life hacks!

Great information!

Thank you