How to Save Money on a Low Income (best money saving tips)

It’s easy to fall into the paycheck-to-paycheck lifestyle when you’re managing a low income. Nevertheless, building a savings is possible!

Incorporate these tips into your money management strategy. Stay committed. Your money will grow.

1. Find Ease – Live Within Your Means

On this journey, unplanned expenses are bound to come up. Without a plan to live within your means, surprise expenses can knock us off our feet and we default back to bad spending habits.

When you live within your means, it brings a sense of ease to money-challenges. They happen, you stay steady, and you naturally keep moving forward.

Because when you can consistently spend less than you earn, saving money happens by itself. Saving money is the effect of good spending habits.

Use a budget to figure out how to live within your means. Look at your income and make adjustments to your expenses until you find that financial ease. With good spending habits, you will have the endurance to keep growing your wealth despite any obstacle.

BONUS TIP: Save thousands when you stop buying these items

Free Workshop – Join our free Simplify Money Workshop

The *only* way to save money is to spend less than you earn. That means you need to decrease your expenses or increase your income.

We want to help you do both.

Join our FREE Simplify Money Workshop to learn the fundamentals of growing wealth. Because when you can spend less than you earn, your money has no choice but to grow. You will build your savings and pay down debt.

What’s more? We’ve got a bunch of free money-hacks to share with you:

- Hacks to lower your monthly bills

- Hacks to spend less on debt

- Hacks to start investing

- Hacks to increase your income by $20/month (with no extra effort)

This workshop has everything you need to accomplish the cardinal rule of personal finance: keep your income over your expenses.

Join our free 5-day Simplify Money Workshop, and start growing your wealth today.

How to Save Money on a Low Income as a Beginner:

Even if you are a beginner to managing your finances, these money saving strategies are easy! Learn how to budget your money efficiently to reduce your money stress for good:

2. Use an Efficient Savings Account

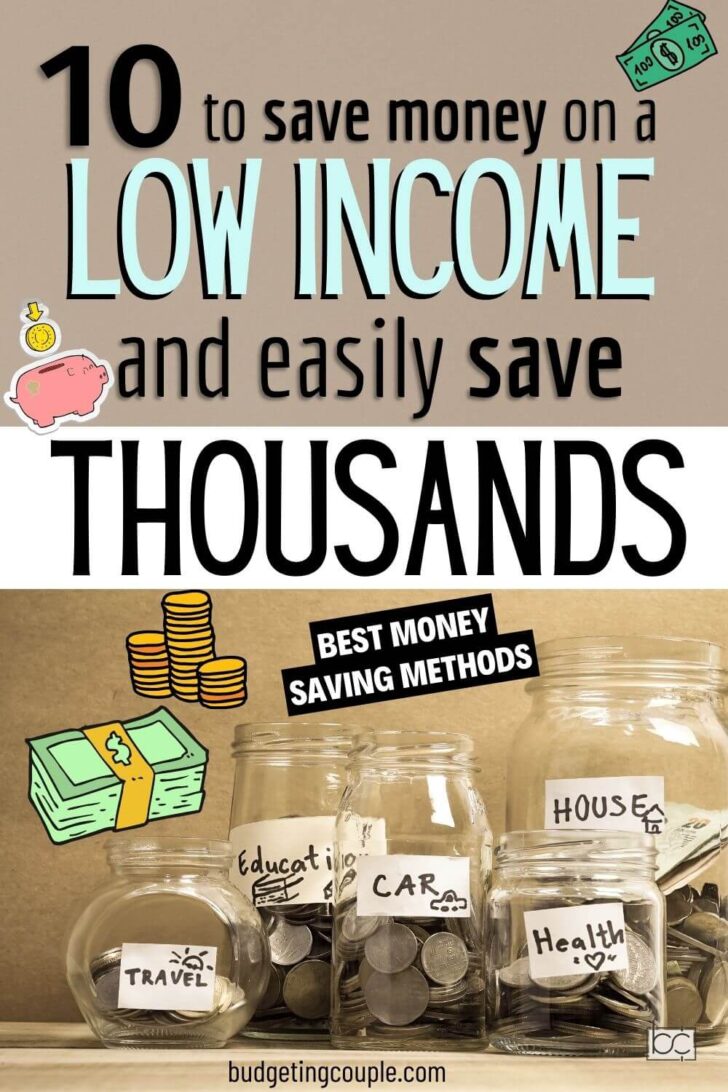

It’s helpful to have a clear delineation between your savings and spending money.

It’s encouraging to add to your savings account and watch it grow. On the other hand, when you dip into a savings to cover an expense, it should feel obvious that you are taking from your separate savings account.

If all of your money is pooled into one account, your savings is just an idea. You’re not going to feel encouraged by its growth and you won’t mind borrowing from it whenever.

Find a savings account with a high APY (an APY is the interest payment that banks pay you to keep money in your savings account). Check out the rates at your local credit union. They are not-for-profit! Which means they have more money to send your way in the form of a higher APY.

Save Money & Earn Money With a High APY

Open a savings account with a higher interest rate (APY).

CIT Savings Builder pays an APY 5X more than the average savings account (APY national average = 0.08%).

Automate your savings! Toggle on the Auto Direct Deposit to have $100/month slide into your Savings Builder account, and you’ll earn CIT’s top interest rate.

(See CIT’s Live banner below for their current APY.)

Open a CIT Bank Savings Builder today and set up automated savings.

These are the tips you need to live on next to nothing!

3. Simplify Your Expenses

Open up your bank/credit card statements and start combing through your expenses.

Where is your money going every month? Cut the expenses that you forgot you had (i.e. subscription services).

Use a calculator to add up your leisurely spending. Small purchases add up faster than you think.

Simplifying your expenses means to be efficient with your money. It’s your money. You earned it. Spend it in a way that is most supportive to your life and happiness.

Find Out: Are you doing one of these bad habits? (they could be keeping you poor)

4. Get Out of Debt

Build a savings? Or pay down debt?

What’s most important is that you have an emergency fund. You want $1,000 in your savings account as soon as possible to cover unexpected emergency expenses. Otherwise, a surprise expense will have you taking on more debt.

But once you have $1,000 in savings, switch over to paying down debt.

It is difficult to build a savings when you are losing money to interest. That is why you’ve got to tackle your debt right away.

Use the debt snowball strategy to pay down your debt. Pay off your smallest debt first. Once it’s paid off, you’ll have more money to put towards your next smallest debt. Do this until you are debt free.

Once you’re debt free and you’re not losing money to interest, then it is time to return to building your savings. You’ll be impressed with how fast your money grows without debt weighing you down.

Try a Balance Transfer Credit Card

Press pause on your interest payment while you tackle your credit card debt.

A balance transfer card can offer 0% interest for 12-18 months (your actual interest rate depends on your credit score).

Check out Credit Land to find a Balance Transfer Card perfect for you.

Each month, Credit Land analyzes the best balance transfer cards with the most competitive no- to low-introductory interest rates.

With an interest rate holiday, you can pay down your debt extremely fast–all of your money will pay down your principal!

Check out these tips to survive on one income!

5. Use an Allowance

Spending can be split into two categories – necessary spending and leisurely spending.

If the expense is necessary, then it is what it is. You got to spend the money.

it is our leisurely spending that can be managed.

To keep leisurely spending in check, give yourself an allowance. Set a budget for $X/month and spend that money however you’d like.

Pro Tip: Let your allowance money rollover. Meaning, if you have unspent money at the end of the month, add it to next month’s budget. That way you can save for a bigger purchases.

Check out the BEST Walmart Hacks + Insider Secrets to Save Money

- Related: 25 Cheap Keto Diet Recipes

Frugal living made easy with these simple tips!

6. Use Free Apps

There are a few apps and services that offer free money. Here are some of our favorite cash back apps and services (they are all free to use):

- Upside: Use the Upside app is earn free cash back at the gas station. You can redeem your money via PayPal, direct deposit, or gift card. Use the promo code AFF20 to grab a 20 cents-per-gallon sign-up bonus. Download the free Upside app.

- Capital One Shopping: Even when you’re living on next to nothing, you still got to buy stuff online. The free Capital One Shopping browser extension is a great way to save money. Capital One Shopping finds valid coupon codes at check out, and it price-checks other online retailers to help you find a lower price. You can also earn free gift cards with loyalty credits. Get the Capital One Shopping browser today.

- Dosh: If you want to put cash-back rewards on autopilot, then Dosh is the app you want. Link your credit and debit cards, and you automatically earn cash-back rewards at participating retailers. It truly is that easy. Download the free Dosh app and watch the cash dash in.

- Scott’s Cheap Flights: Find the best deals on flights coming out of your airpot. Just tell Scott where you want to go. When a deal pops up, an email will be sent to your inbox (deals range from 40%-90% on average). Sign up for Scott’s Cheap Flights to grab your free 14 day trial (and save 20% on a one-year membership with promo code BUDGET20.)

- Rakuten: When you shop online, the free Rakuten browser extension automatically alerts you to cash-back and coupon-saving opportunities. Get the free Rakuten browser extension

- Insurify: Insurify is a free service that compares insurance rates across the top home and auto insurance providers. Input your policy information, and Insurify will scan for similar policies at better rates than you’re getting.

Use these tips to DRASTICALLY lower your household bills and expenses!

7. Downsize

If you’re living on the bare minimum and you’re still struggling to build your savings, your expenses may be too great for your income. You may want to consider downsizing.

Can you sell a car? Can you move into a smaller home? Can you move to a less expensive city?

Don’t be afraid to make a big move!

Getting income over expenses opens every financial door. Your wealth is growing with every paycheck! Know that you can upgrade down the line.

8. Try Living on Nothing

If you’re not interested in budgeting or if you want to build your savings as quickly as possible, try living on nothing.

Living on nothing means spending the absolute minimum. There is no eating out. There is no allowance budget. There is no leisurely spending.

Since there is no leisurely spending, you actually don’t need to budget with this strategy. Just don’t spend money.

We definitely recommend a budget over living on the bare minimum, but we don’t slight this strategy. If you’re in the headspace that nothing is going to stop you from achieving your money goal and you want it done as soon as possible, living on nothing works.

- Related: 10 Tips to Live on Nothing

9. Declutter To Sell

Consider selling your stuff to reach your savings goal faster. Listing items on FB marketplace can bring in a decent amount of cash, and it can be done in your free time.

Take a look around your house and start making a list of items you could potentially sell. Look up those items on Amazon to help yourself set a price. You can also use Amazon’s description for your online listing.

Not to mention, decluttering makes your home cleaner, more functional, and spacious.

We highly suggest you try decluttering as a means to grow your savings faster.

- Related: 5 Things Frugal People Never Do

Copy these genius habits of successful women to save money fast!

10. Stay Curious

It’s great that you looked up an article on how to save money on a low income. Stay curious. Keep looking for another avenue for growth.

Can you increase your income at work? Can you start a part-time business? Is there another expense you can cut? Is there a more cost effective way to complete a task?

Our problems are our biggest teachers. Keep an open mind, face the challenge, and you will find yourself on the other side grateful for the experience.

One income living is easy with these genius hacks!

11. Stay Steady

When it comes to savings goals, it’s emotionally challenging to wish they were complete.

Try to stop looking towards the finish line. You’ve already created a plan to keep income over expenses. Let your savings goals happen on their own.

All you can do is fill your day. Be productive when it is time to be productive. Give yourself time to rest and recuperate. Make it a point to get enough sleep (rather than scrolling social media late into the night).

Building a sizable savings takes time, so try to be patient. There will be surprise expenses. There will be setbacks. But when you have a plan to keep income over expenses, you are moving forward.

RESOURCES IN THE IMAGE ABOVE:

1 – Live on Next to Nothing With These Saving Money Tips

2 – Habits of Women Who Never Overspend

3 – Stop Buying These Things to Save Money Fast

4 – How to Cut Your Household EXPENSES Drastically

Related: cheap living tips for frugal living!

More Ways to Save Money

Resources In The Image Above:

1 – Simple Hacks to Live on One Income

2 – The Best Hacks for Cheap Living

Thank You For Sharing the content

Thank you!!!

Bobby you have done some great justice to this blog. The topic and content are highly intriguing and i did not move an inch while reading it.

Thanks