Ultimate Guide to Saving Money

This post may contain affiliate links. Please read our disclosure for more info.

Nearly 40 percent of Americans have difficulty taking care of a $400 emergency[source]. Perhaps you’ve been there. Maybe you got sick but couldn’t pay the bill or afford the prescription. Did you ever have to ride your bike to work because you couldn’t afford to fix your car?

To overcome unexpected financial hurdles, you need money in savings. You need to have at least 3 months worth of expenses in the bank. But, when you struggle to find the cash to make it through to the next payday or don’t have two nickels to rub together because the car or student loan payment is higher than you’d like, just thinking about saving 3 months of expenses is enough to make you feel anxious and powerless.

Trust me, there is a light at the end of the tunnel. You can improve your financial situation, if you do just one thing: Spend less than you earn.

That’s the entire mission behind this post. We want to help you save money so you can build up your savings. It’s easy. You can realistically add thousands of dollars to your savings. But, you have to act. It all starts with a decision.

15 Money Hacks to Grow Your Savings

1. Cut Costs Where You Can

Cutting expenses normally means cutting out the fun stuff. What if I told you there was a way to cut expenses automatically? Got your attention? Invest a few moments of your time to check out these apps and services and see how you can start saving money today.

Trim

Think of the Trim App as your automated personal finance assistant. Tapping into AI, Trim will search for opportunities to save you money on your cable and internet bills, and monthly subscriptions. On top of that, Trim will also look for subscriptions you still pay for but might not use any longer.

Just connect your checking accounts and credit cards, and it will scan them, looking for recurring payments and ask you if you want to cancel or negotiate a lower rate.

Trim has already helped people save more than $20 million. How much do you think it will save you?

Find out when you sign up for Trim today.

Balance Transfer Credit Cards

If you have credit card debt, you know it’s a struggle to pay down. It’s because of the interest. When you’re stuck with a 10%+ interest rate, becoming debt free is a slow boat to China. Let’s fix that…

Balance Transfer Credit Cards offer 0% interest for 12 to 18 months (actual rate is based on your credit score). That means for an entire year, you could put money towards your debt and 0% would go towards interest. It’s an opportunity to pay down debt aggressively.

Balance transfer credit cards give you a window of opportunity. If you want to pay down debt, take interest off the table so that you can pay down debt as quickly (and with as little money) as possible.

Find a secure Balance Transfer Credit Card here (look for 0% APR)

Even more resources to help you save money

- How to Lower Your Bills (effortlessly)

- 5 Household Hacks to Save Thousands

- 9 Tips to Save Money on One Income

2. Download These 4 Cash-Collectors

OK, you have a number of strategies to cut expenses, now let’s focus on increasing your income with free money. That’s right, free money for doing things you already do.

Here are our Top 4 money-saving apps you can use to start building cash-back rewards. Do yourself a favor and use them all in conjunction with each other to stack your rewards. This is like stacking coupons in the digital age. Let’s go:

Ibotta ($20 Bonus)

The average Ibotta shopper earns $150 a year. If you would rather the grocery store keep that money, then do nothing. If you want what’s coming to you, download Ibotta.

Ibotta gets you cash-back on groceries. When you download the app, activate your account, choose the cash-back rewards from your grocery store, use your app at check out, and watch your free money grow.

Be prepared to go in for what you need and selected, and you will leave the store with a smile on your face when you see how easy it is to earn free cash.

Ibotta is free to download plus you’ll get a $20 bonus when you claim your first free money offer (within 14 days)!

See Ibotta in action. Check out our Ibotta explainer video.

So, if you like free money… Download the Ibotta App here and grab a free $20 gift card just for trying it out!

Want all of the Ibotta deets? Here’s an in-depth review of Ibotta we think you’ll find interesting.

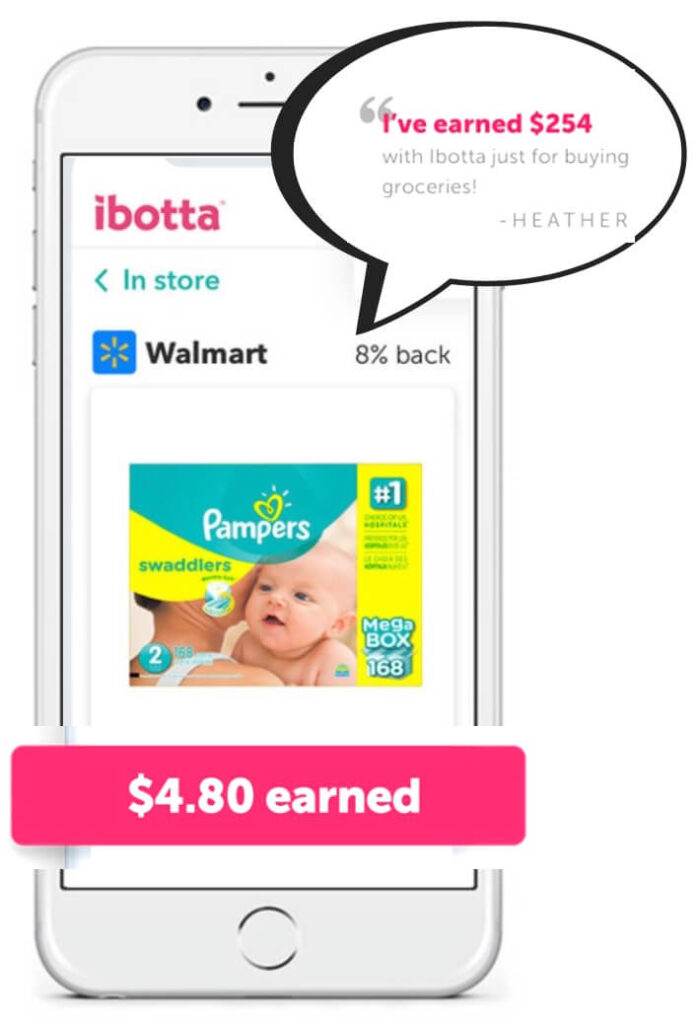

Dosh ($1 Bonus)

How does cash back automatically sound to you? You will love using the Dosh app because it pays you in cash, not points. Link your credit and debit cards, and earn cash back when you buy from the thousands of Dosh affiliated stores, restaurants, and online retailers:

- Walmart – 3% Cash Back

- Target – 1.5% Cash Back

- Bed Bath & Beyond – 7% Cash Back

Get your first bonus by linking your first credit card, and enjoy how Dosh works automatically.

Download the free Dosh App now and grab a $1 welcome bonus.

We know how important cybersecurity is. Read about how Dosh is safe and secure, and also get the skinny on the app by reading our Dosh review.

Rakuten ($10 Bonus)

When you install the Rakuten (formerly Ebates) Chrome (or Safari) browser “button”, it will open up a world wide web of cash back possibilities. As you shop online, if there is an opportunity to get some cash back, the Rakuten button will alert you. Just click the button to activate the rewards.

Some deals are up to 40 percent cash back. Set it and forget it. Rakuten works on autopilot to get you free money.

Sign up, save, and get paid with Rakuten (and grab your $10 bonus).

Already have an Ebates/Rakuten account? Download the free Ebates/Rakuten browser button here (available on Chrome and Safari) to start saving money on autopilot!

There is so much to like about this service, as you will learn in our full Rakuten Review.

Upside (20 cents-per-gallon sign-up bonus)

Had enough of high gas prices? Do something about it with a free app that pays you cash back when you fill your tank at the pump. And, if you use our promo code, then you will save even more!

Upside, formerly GetUpside, is a cash-back app that focuses on local businesses. You will start earning rewards with just a few taps at gas stations, grocery stores, and restaurants.

Download the free Upside app, sign up, look for offers around you. When you see something you like, claim it. Visit the establishment to purchase your gas, food, or meals with your linked debit or credit card. When done, just check in on the app.

Upside started as a cash-back app for gas and has been adding grocery stores and restaurants. The app works at 45,000 locations across the United States.

Choose how to get paid: PayPal, bank account, or gift card. Start earning cash back at nearby stores when you install the Upside app. Use the promo code AFF20 to grab a 20 cents-per-gallon sign-up bonus. Best of all, Upside is a free app. Get some free cash-back today.

Want even more cash back opportunities?

> The 11 Best Cash Back Apps of 2020 <

3. Collect Free Money with a High Yield Savings Account

Are you leaving money on the table when it comes to your savings account? Would you rather earn 15X more interest than what the typical interest rate pays? It is within reach when you deposit money into a high yield savings account. You will earn a higher interest rate.

The FDIC reported that the national APY for a savings account was 0.09%. If you had $1,000 deposited, you would earn a whopping 90 cents per year … less than a buck.

APY refers to Annual Percentage Yield. The higher your bank’s APY, the more free money you get.

With a 1.55% APY:

- $1,000 in savings = $15.50 a year in free money.

- $5,000 in savings = $77.50 a year in free money.

- $15,000 in savings = $232.50 a year in free money.

What would happen if you didn’t take a few minutes to open an account with a high APY?

With a 0.09% APY:

- $1,000 deposited = $0.90 a year in free money.

- $5,000 in savings = $4.50 a year in free money.

- $15,000 in savings = $13.50 a year in free money… less than what you would make with just $1,000 deposited with a high-yield savings account..

If you blindly open a savings account, you are leaving money on the table in the form of interest lost on a low APY.

Let’s remedy this. Choose a bank with a high APY.

Best High-Yield Savings Accounts

CIT Bank

The higher your banks APY, the more money they pay you to bank with them. So don’t settle for an average APY of 0.08%. CIT’s Savings Builder account offers soaring interest rates that are at least 10X the national average. Check out CIT’s live banner below for the current Savings Builder APY.

Check out the CIT Savings Builder account here, see how easy it is to open an account, and see how the interest rates will benefit you.

Start earning free money when you open a CIT Savings Builder account today.

Related: Best Free Checking Accounts for 2020

5. Cash-Back on Everything

OK, we’re on our fifth and final hack. By now, you incorporating all of these tactics and strategies will have a multiplying effect that can literally save you thousands of dollars a year, if you are just average. Now, we are going to kick it up a notch by recommending you use credit cards to your advantage, whether they are cash-back cards or travel rewards cards.

Credit cards are a tool to help you reach your financial goals. Use them to your advantage. We are not recommending piling up new debt and buying things you cannot afford. However, if you buy stuff online, use a cash-back card, get Rakuten cash-back rewards and let Dosh work its magic.

You might not be in a position to do this, but a father used to put his son’s college tuition on a Discover cash-back card. If tuition, room and board came up to $25,000, then he made a cool $500 with a 2% cash back reward.

Cash Back Cards

With cash back cards, you earn points for every dollar you spend. Generally the incentives are 1-2%, but it can go higher, especially during an introductory offer.

Some recent offers over on Credit Land included:

- 5% cash back rotating categories

- 1.5% back on every purchase + a one-time bonus of $150

- 2% cash back on everything.

Go over to Credit Land to find the right cash back card for you and start earning even more rewards.

Travel Cards

With cash back credit cards we speak of points, but with travel credit cards we speak of miles. Whether points or miles, we are referring to the same thing: Rewards. When looking at travel cards, keep in mind 100 miles equates to about $1 in travel benefits.

You might be thinking, why would I get a travel rewards card, I don’t fly much. These rewards cards are not frequent flyer programs. They build up cash rewards that can be used for travel. Some cards will pay you cash back. Some cards will give you 2X miles when you use your card at grocery stores, restaurants or gas stations.

Having said that, some travel cards are linked with airlines that will give you certain privileges, like getting your entire family’s first checked bag for free. That’s a $200 round trip savings for a family of 4. Keep that $200 in your savings account!

When looking at a travel credit card, there are a lot of options. Look for one with a high sign-up bonus. You will get the most miles through the sign-up process.

Check out the travel rewards cards at Credit Land to find the best one for you.

How to make money with your credit card

If you want to make money with your credit card, and build your savings even faster, you can never go into credit card debt.

The key here is to pay off your balance every month. You do not want to be in a position where you are paying 15-20% interest on balances just to chase 2% in cash back. That makes no sense, and it goes against all we teach.

Also See: 9 Dave Ramsey Tips You Need to Destroy Debt

6. Spend Money Strategically with a Budget

For some, budgeting is a four-letter word. That’s a shame. We mentioned above how finances contributed to a lot of stress, worrying, and loss of sleep. Budgeting can help erase a lot of that.

A budget is simply a plan that will move you toward financial freedom. List all expenses and compare them to how much money you earn. Then craft a plan to spend less than you earn.

Commit to your plan. It is your roadmap to a better future. Every month should get easier for you as you figure out where you can cut spending. At the same time, you will benefit from all of the hacks you implemented.

So far in this post, we have shown you ways to cut expenses, ways to save money through cash back apps, and how to earn a higher interest rate on your savings. But, now, we are going to focus on changing how you handle money to save more, and live life with a peace that comes through financial security. It all starts with a decision.

Free Workshop – Join our free Simplify Money Workshop

The *only* way to save money is to spend less than you earn. That means you need to decrease your expenses or increase your income.

We want to help you do both.

Join our FREE Simplify Money Workshop to learn the fundamentals of growing wealth. Because when you can spend less than you earn, your money has no choice but to grow. You will build your savings and pay down debt.

What’s more? We’ve got a bunch of free money-hacks to share with you:

- Hacks to lower your monthly bills

- Hacks to spend less on debt

- Hacks to start investing

- Hacks to increase your income by $20/month (with no extra effort)

This workshop has everything you need to accomplish the cardinal rule of personal finance: keep your income over your expenses.

Join our free 5-day Simplify Money Workshop, and start growing your wealth today.

Save More Money! Read these next…

- 43 Hacks to Live on One Income & Never Be Poor

- 9 Things to Stop Buying to Save Money Fast

- 5+ Old-Fashioned Money Tips From Grandma