Frugal Living Guide: 35 Simple Tips to Live Frugally While Enjoying Life

Do you want to save more money while working toward your financial goals? Frugal living is one of the best ways to accomplish both.

If you’re ready to live a life of frugality, here’s what you need to know.

Living Frugally- Table of Contents:

- Get the Most Out of Every Dollar

- Keep More Money in Your Wallet

- Be Frugal With Returns

- Conduct Research

- Decrease Your Expenses

- Frugal Driving Tips

- Budget Your Way to Frugality

Frugal Living Guide: Start Living Frugally with these 35 Simple Tips

If you’re ready to live a life of frugality, try these 41 frugal ideas to get you started.

Get the Most Out of Every Dollar Spent

Living a frugal lifestyle is also about getting the biggest bang for your buck. You want to get the most out of each dollar you spend. A great way to do this is to use Cash Back apps. Here are a few apps that can help you live the ultimate frugal life.

1. Effortless Cash Back on Every Purchase ($20 Sign-Up Bonus)

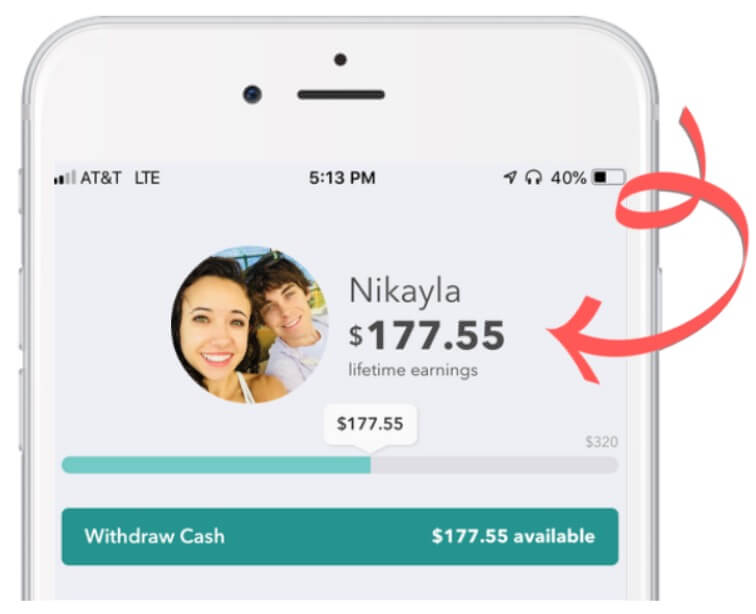

Ibotta is the easiest way to get immediate cash back on the groceries you were already going to buy.

After you download the free Ibotta App, you’re instantly set up to start racking in free money. Simply browse the app for offers that qualify for cash back rewards. Once you purchase a qualifying item, take a photo of your receipt to receive your free money.

You can turn in your Ibotta money for PayPal payments, Gift Cards, or Venmo payments.

We have over $100 in our Ibotta wallet from doing our *normal* grocery shopping trips every week. ^^See Above^^ (And that doesn’t include all of the free Starbucks gift cards we’ve already treated ourselves too.)

Aside from *paying you* to shop for groceries, they also hand out free money for buying apparel, cosmetics, toiletries and more.

Grab this $20 Welcome Bonus for downloading Ibotta today.

Want to hear even more ways Ibotta can save you money? Check out our Ibotta explainer video, here!

2. Stick to Your Frugal Lifestyle by Earning Cash Back on Your Everyday Transactions

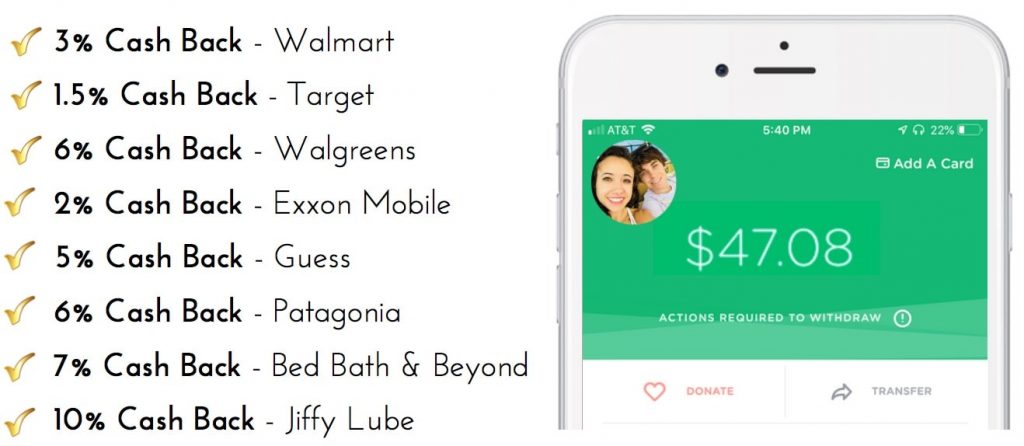

The Dosh App is a great tool for helping you live a frugal lifestyle. Simply link your debit or credit card to the Dosh app and start earning up to 10% cash back on your everyday transactions.

With over 1,000 stores and restaurants, you can earn cash back almost everywhere you shop and eat!

Once you start earning Cash Back, you can transfer your funds to your bank accounts, PayPal account , or donate it to charity.

You can also Earn $5 for each friend you refer to Dosh.

Grab your $1 Bonus for Downloading the Dosh App today

3. Earn Cash Back Rewards for Using Your Credit Cards

When used responsibly, credit cards are a great way to earn Cash Back on your everyday transactions. Cash Back credit cards pay back a percentage of what you spend (sometimes more than 5% cash back).

Depending on how you spend money and where you shop, you can earn Miles and Points (fancy talk for Cash Back) and Bonus Membership Perks (e.g. free checked baggage. That’s $50/person/trip!) .

Find the card that REWARDS YOU MOST:

- If you travel at least one time per year, These Travel Credit Cards will save you hundreds every trip.

- If you’re only earning 1% Cash Back on purchase, it’s time to make a switch. Here are the top Reward Credit Cards of 2019 (we use #7).

Related Post: Struggling with Credit Card debt? Here’s a step-by-step guide to wipe out credit card debt fast.

4. Cash Back at Over 2,500 Retailers

To achieve true frugal living, you will want to maximize every dollar you spend.

Rakuten (formerly Ebates) is the king of online shopping cash back offers with over 2,500 retailers to choose from. Aside from the 40% cash back they offer, Rakuten’s site also has a hidden trove of coupon codes, free gift offers, deals, and flash sales!

You can receive either a ‘Big Fat Check’ or PayPal payment every quarter for using promo codes and shopping the latest deals and discounts right from your phone.

Create your free Rakuten (Ebates) account today and get a $10 Bonus

5. Turn Receipts into Effortless Dollars

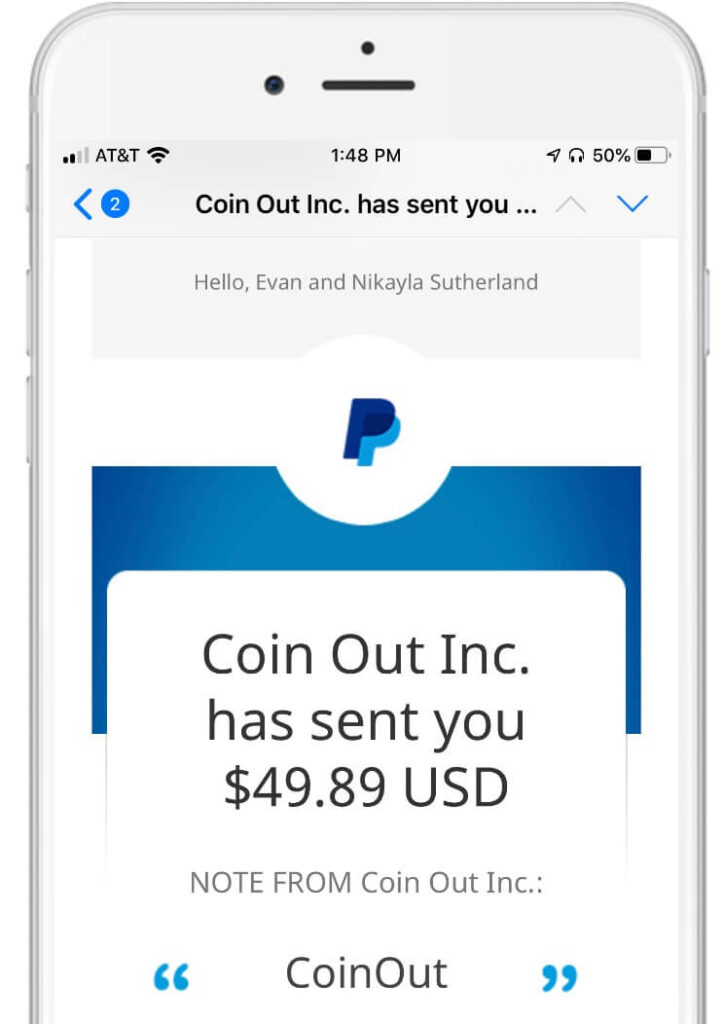

If you don’t want to spend the time searching for coupons and discounts, the CoinOut App (as seen on Shark Tank!) can help you find rebates right from your receipts. Just upload your receipts to the CoinOut app and they will automatically send cash your way.

CoinOut is one of the easiest ways to earn cash back on your everyday purchases. (Check out the last PayPal deposit they sent us above ^^)

6. Give Your Children the Best Chance to be Financially Stable with Greenlight

Do you want your children to avoid the financial pitfalls you faced? There’s a way you can teach them to spend appropriately, save intentionally, and give generously with Greenlight, the debit card for kids and teens. Greenlight lets you teach your children a proper money mindset, and all the while you are in control of how much money your kids can access, along with how and where they can spend their money.

With spending limits you set with the Greenlight app, your children will learn how to best use their money. Should they spend their money on candy or save for that Xbox?

Empower your children to make smart decisions with their money with a Greenlight debit card for kids (you can have up to five cards for one low, monthly fee). Sign up for Greenlight today and get your first month free.

Free Workshop – Join our free Simplify Money Workshop

The *only* way to save money is to spend less than you earn. That means you need to decrease your expenses or increase your income.

We want to help you do both.

Join our FREE Simplify Money Workshop to learn the fundamentals of growing wealth. Because when you can spend less than you earn, your money has no choice but to grow. You will build your savings and pay down debt.

What’s more? We’ve got a bunch of free money-hacks to share with you:

- Hacks to lower your monthly bills

- Hacks to spend less on debt

- Hacks to start investing

- Hacks to increase your income by $20/month (with no extra effort)

This workshop has everything you need to accomplish the cardinal rule of personal finance: keep your income over your expenses.

Join our free 5-day Simplify Money Workshop, and start growing your wealth today.

Be Frugal with Refunds

You may not want to spend your valuable time searching for Deals and Discounts. Fortunately, there are tools and resources you can use that help you discover rebates and refunds on the items you already buy.

Here are a few options to help you get started.

7. Trim Your Subscription Services

According to research conducted by Waterstone Group, 84% of consumers underestimate what they spend on subscription services each month. From Spotify to Netflix, your subscription services can add up.

If you’re unsure how to cut back, try using an app like Trim.

The Trim app makes saving money automatic. By analyzing your spending habits, Trim is able to find recurring subscriptions (you may have forgotten about) and will cancel them for you on the spot.

One of our favorite features is their lowest price negotiation tool!

Are you getting ripped off by your cable or internet provider? Trim will negotiate that bill down for you, AKA saving you tons of money every single month. Trim users have saved over $1,000,000 in the last month alone.

Please note that Trim takes their payment immediately. For example, if Trim saves you $10/month, they will request their 33% fee ($40) right away. But you keep 100% of the savings after that.

Here’s someone that is set up to save $50/month forever thanks to Trim:

“Trim was able to negotiate with my cable company and provide more than $50 in monthly savings from my cable bill; all within the first week!”

Daniel H.

Click here to download the free Trim App and start saving money effortlessly.

Related Post: The Easiest Ways to Lower Your Bills in 2020

Free Workshop – Join our free Simplify Money Workshop

The *only* way to save money is to spend less than you earn. That means you need to decrease your expenses or increase your income.

We want to help you do both.

Join our FREE Simplify Money Workshop to learn the fundamentals of growing wealth. Because when you can spend less than you earn, your money has no choice but to grow. You will build your savings and pay down debt.

What’s more? We’ve got a bunch of free money-hacks to share with you:

- Hacks to lower your monthly bills

- Hacks to spend less on debt

- Hacks to start investing

- Hacks to increase your income by $20/month (with no extra effort)

This workshop has everything you need to accomplish the cardinal rule of personal finance: keep your income over your expenses.

Join our free 5-day Simplify Money Workshop, and start growing your wealth today.

8. Get Refunds for Your Bank and Credit Card Fees

Don’t you hate it when the bank charges an unnecessary fee for simply using your own money? Using the Cushion app can help you fight back and negotiate all of those unwanted banking and credit card fees. Cushion’s bot haggles on your behalf and can send you a refund summary within 24-hours.

The best part is, Cushion is 100% Free to use. However, if they eliminate one of your fees, Cushion takes 25% of the refunded amount.

Let Cushion do the heavy lifting for you and help waive those pesky banking fees.

Keep More Money in Your Wallet By Minimizing Food Costs

In 2017, the Bureau of Labor Statistics reported that the average American spent $7,729 annually on food alone. This includes dining in and out. Nutrition doesn’t have to come at such a high price.

There are plenty of ways to cut back on food costs and focus on a more frugal way of living. Here are a few frugal ideas for minimizing your food expenses.

9. Save Money, Time, and Energy with $5 Meal Plan

Wouldn’t it be nice to save money and time preparing your family meals? Well now you can.

For $5 a month, $5 Meal Plan will send you a delicious and inexpensive meal plans every week. No longer will you need to spend hours each week worrying about what to make for dinner, $5 Meal Plan will take care of it for you.

Get a Free 14-Day trial by signing up for $5 Meal Plan today.

10. Minimize The Cost of Buying Organic

From Paleo diets to a gluten-free way of living, many Americans are taking steps to get healthier by changing the way they eat. Some of these food choices can be more expensive than their processed alternatives.

Using a site like Thrive Market can help you save up to 50% on your favorite organic and non-GMO brands. On top of that, you can have your favorite foods delivered right to your front door.

By becoming a Thrive Market member you also get the chance to earn Free Gifts, Rewards, and sponsor a low-income family’s membership.

If you want to buy the brands you love for less, sign up for your Thrive Market 30-Day Free Trial.

11. Get Inspired While Saving Money

If you love tips and tricks for healthy living, you will love Vitacost. With Vitacost, you can receive deals, discounts, recipes, expert tips, and more for living a healthy lifestyle.

You can save on everything from collagen to cleaning products all in one place.

Join Vitacost today and receive 20% off your first order.

12. Save More by Dining at Home

Eating out can add up. Imagine if you were to eat out every day for lunch and on each outing you spent about $10 per meal. You would end up spending $2,600 a year for just eating out during your lunch hour. If you want to find a more frugal way to live, it may be beneficial to eat most of your meals at home.

Here are a few other ways you can save by dining in.

13. Make a Grocery List

How often do you find yourself browsing the aisles of the grocery store and then purchasing more food than you intended to? If you want to live a frugal lifestyle, it’s important to make a list every time you visit the store. Making a grocery list will help you stay within your budget and only purchase the items you actually need.

Before you venture to the store, take an inventory of everything you already have and only purchase the items you need.

14. Purchase Generic Items

Frugal living is about getting the most value out of each dollar you spend. Being loyal to one brand may not help you get the most bang for your buck when grocery shopping.

Purchasing generic items can help you save money and they may be just as good as their alternatives. If you’re committed to frugal living, try buying generic.

15. Receive Fresh and Inexpensive Ingredients Delivered Right to Your Front Door

Instead of going to the grocery store, why not have your meals delivered right to your front door. With Home Chef, you can select the pre-portioned ingredients and chef-prepared recipe cards to make healthy meals for you and your family.

If you want to take the time and cost out of meal prepping, Home Chef is the perfect solution.

Sign up for Home Chef today and receive $30 Off your first meal.

Conduct Research to Get the Most Out of Your Vacation Dollars

Just because you live a frugal life doesn’t mean you can’t go on vacation or splurge on activities. However, it’s important to do proper research to find the best deals and discounts.

Conducting the proper research with help you maximize your money. Here are some vacation options to make your travel savings go further.

16. Rent a Getaround Car – Earn $80/month

Instead of renting a car from a costly rental company, try Getaround for an inexpensive alternative. Getaround allows you to rent cars for as little as $5 per day.

All you need to do is sign up and start renting cars from great people around the city.

If you enjoy saving the environment while making a little extra cash, Getaround also offers car owners the opportunity to earn up to $1,000 per year.

17. Stay in Rentals Instead of Expensive Hotels

Sites like Airbnb and VRBO offer cost-effective accommodation options for your vacation. With these sites you can rent entire properties or just a room for a short stay.

Using these sites not only helps you live cheap but they also give a more authentic vacation experience. For example, if you choose to stay with a local family, your hosts can help you become familiar with the area and share the secrets that lie within their city.

Hotels may not offer the same experience. Start browsing vacation rentals and discover options that’s fit within your budget today.

18. Avoid Toll Roads

If you prefer road trips over flight travel, toll roads can eat into your budget. If you have an iPhone you can set your maps app to avoid toll roads.

Here’s how to set it up on your phone:

Setting > maps > driving/navigation > Avoid Tolls (on)

19. Vacation During the Off Season

Vacation rates can fluctuate based on the season you choose to travel. For example, if you want to visit the beach on spring break, you may be looking at expensive flights and accommodation rates. Instead of going to a desired location during the high season, vacation during the off season.

You may be able to find better deals and discounts based solely on the time you choose to travel.

20. Setup Price Alerts

Flight prices can fluctuate daily. If you don’t want to spend your time browsing the internet for the best deal on flights, set up a price alert for your desired location. Sites like Kayak and Travelocity will send you notifications when your flight has dropped in price.

Setting up price alerts can save you time and money. Why waste your time comparing rates, when you can have someone do it for you?

Decrease Your Expenses

Decreasing your expenses gives you more room to prioritize your spending. If you want more flexibility with how you spend your money, here are a few ways to cut your expenses.

Also See: Minimalist Living Guide

21. Invest in a Programmed Thermostat

Investing in a programmed thermostat is a great frugal tip for saving on heating and cooling costs. Installing a remote thermostat allows you to control the heat and AC right from your phone. If you’re away, remote thermostats will let you adjust the temperature of your home to prevent you from wasting energy.

Spending a little bit of money on a remote thermostat could potentially save you hundreds of dollars on your electric bill.

Related Post: Cut down your electric bill with the top energy-efficient products on Amazon!

22. Spend Less on Debt (Consolidate Your Debts)

Consolidate means to combine. Debt consolidation means to combine all of your debts into one, simple to manage debt. While the simplicity of having one bill/month is reason enough to consolidate, there’s an even better reason: you will pay less in interest – you will get out of debt for less money.

For example, let’s say you have 3 separate credit card debts. You’re probably paying +15% interest on each bill. Stop throwing away money on interest. Consolidate your credit card debts into one monthly payment. You’ll spend less on interest which means you will pay off your debt faster with less money.

Forget the debt snowball. Debt consolidation is the fastest, cheapest, most efficient method for getting out of debt.

23. Find Cheap Activities to Do With Your Friends

Happy hour and weekly nights out with your friends can become expensive. Look for inexpensive ways to spend time with your friends instead of spending money on entertainment.

For example, instead of meeting for dinner, invite your friends over for appetizers. You can ask each one of your friends to bring a different item to help minimize the cost.

There are plenty of ways to spend time with your friends that don’t have to cost a ton of money. Get creative and try something new for your next gathering.

24. Cut Your Health Care Spending

Health care may be one of your most expensive costs yet.

Liberty HealthShare offers families and individuals an affordable way to manage their medical expenses. Liberty HealthShare members make a monthly contribution online, which is then paired with a medical need within the group.

This diverse community is committed to supporting medical expenses after the annual threshold is met.

If you want to join a community that supports your medical needs, try Liberty HealthShare.

25. Visit the Library to Save Money on Entertainment

Instead of renting movies from Netflix or visiting your local movie theater, stop by the library to review their entertainment options. Most libraries allow you to rent books, movies, magazines, and more for no cost.

Using the library is a great frugal tip to help you cut costs.

26. Minimize Your Grooming Trips

According to Angie’s list, haircuts can range in price from $10 to $100 per visit. If you usually visit a salon every few weeks, getting your haircut can be extremely expensive. Instead, try to prolong your visits or find a friend or family member who can cut your hair for a cheaper price.

Additionally, if you enjoy getting your nails done every two weeks, try doing them yourself.

Frugal tip: You could even make it a group event with all of your friends and do your nails together. It’s a great way to spend time together while saving money.

27. Rent Out Your Space

If you have an extra space in your home, why not put it to good use and rent it out to someone in need? Whether you have an extra room or an entire wing of your property going unused, list it on a site like Roomster for semi-permanent to permanent renters.

List your property today and be one step closer to ultimate frugal living.

Frugal Driving Tips

Depending on where you live, transportation can take up a large portion of your budget. From gas to car maintenance, owning a vehicle is a huge expense. But, there are other options to help you save on your transportation costs.

Here are a few alternatives you should consider.

28. Download Apps to Help You Save on Gas

How would you like to save $340 a year? Let’s be honest, who wouldn’t?

By using apps like GasBuddy, you can Save on Gas, Win Prizes, and get Rewards. GasBuddy tells you where the nearest gas stations are and which ones have the lowest gas prices.

You can also win free gas for competing in different challenges.

Get Free Cash Back With This Free App

If you are already using GasBuddy, you might as well add Upside, too.

Upside, formerly GetUpside, is an app that will get you cash back at gas stations, grocery stores, and nearby restaurants with just a few taps.

And, if you use the Pay with GasBuddy feature, you can add it to your Upside Wallet. So, GasBuddy will find discounted gas for you, and Upside will score you some cash back so you can save even more on fuel.

When you download the free app and sign up, you will see cash-back discounts and exclusive offers in Upside. Claim your offer, visit the establishment, complete your transaction, pay with a linked debit or credit card, check-in, and wait for your cash back rewards to roll in.

Upside works at 45,000 locations across the United States. It started as a cash-back app for gas but has been adding grocery and restaurant chains.

If you use the Pay with GasBuddy feature, you can add it to your Upside Wallet. So, GasBuddy will find discounted gas for you, and Upside will score you some cash back so you can save even more on fuel.

Get paid via PayPal, bank account, or gift card. Start earning cash back at nearby stores when you install the Upside app. Use the promo code AFF20 to grab a 20 cents-per-gallon sign-up bonus. Get the free app today.

29. Drive Gently

Did you know that driving aggressively can put more wear and tear on your vehicle? Did you also know that it can increase your use of gas? By driving gently, you can help preserve your car as well as Save on Gas.

Driving better may even help you relax during a traffic jam. After all, who enjoys feeling road rage?

30. Walk When You Can

If you live close to work or shopping areas, you may want to walk instead of driving your vehicle. Walking is a great way to reduce transportation costs, get exercise, and save the environment.

If walking isn’t an option, try investing in a bike. It may take you a little more time to get to your desired destination but the extra time could be worth the money you’re saving.

Even if you just eliminate one trip a week, you could drastically see a decrease in your transport expenses.

31. Ask Your Employer if You Can Work from Home

With the advancements in technology, many employers are allowing their employees to work right from home. This saves employees commute time and transportation costs.

If you don’t already have the option to telecommute, speak with your employer and ask if they would be willing to let you work from home. If you need a little help starting the conversation, try this.

32. Consider Becoming a One-Car Home

If you and your spouse work in close proximity to one another, you may want to consider becoming a one-car household. Owning only one car can help you eliminate the maintenance headaches and cut some of your transportation costs.

Becoming a one-car household is also a great way to spend more time together. What could be better than saving money and getting closer to your spouse?

33. Keep Up with Car Maintenance

Keeping up with your vehicle’s maintenance is vital to keeping your car running. As a frugal consumer, you want to do everything you can to avoid costly repairs or the purchase of a new car.

Be sure to get your oil changed, replace filters, and get routine checkups to keep your car running efficiently.

Budget Your Way to Frugality

In order to maintain a frugal life, you must understand the money you have coming in and going out. A well-designed budget can help you spend less, pay down debt, and save more.

Creating a budget gives you the freedom and flexibility to spend money the way you want. It allows you to prioritize your spending and achieve all of your financial goals. If you’re ready to boost your frugality, here’s our ultimate guide to creating a budget.

34. Use the 50/30/20 Rule

You may also want to consider using the 50/30/20 rule. This means that you use 50% of your budget toward needs, 30% of your budget toward wants, and 20% of your budget toward savings.

- Needs includes: groceries, transportation, housing, and insurance

- Wants includes: shopping, eating out, vacation, and entertainment

- Savings includes: saving goals, retirement, and investments

The 50/30/20 rule can be used as a guideline to help you achieve a frugal lifestyle.

What Does Frugal Living Mean?

Frugal living means predominately saving and not wasting your financial means. By living frugally, you prioritize saving and make good use of the resources already available to you. Every purchase you make is carefully considered and thought out.

Being cheap and being frugal are not one in the same. There’s a difference between prioritizing your spending and spending the least amount possible. When someone is cheap, they are more concerned with the bottom line than the actual value they’re purchasing.

For example, a frugal person may look for coupons when dining out, while a cheap person may not leave a tip no matter how good the service was. See the difference?

Why Live Frugally?

Frugal living helps you be more mindful with the money you earn. When you’re frugal, you are more intentional about your purchases and how you choose to spend your money. You carefully consider each purchase for the value it adds instead of the price.

By focusing on value instead of price, it may help you spend less because your purchases last longer.

Frugal living doesn’t have to be challenging. By using these simple frugal tips, you can prioritize your spending and stay within your means.

Do you have any favorite frugal living tips? Let us know in the comments down below.

Be sure to follow us on Pinterest for more simple tips to live frugally the year!

Save these tips for later by bookmarking this page or Pinning it here!

Hi Ashley!

No doubts, frugal living is essential, if you have limited income. One must be disciplined enough in cutting down expenses when the time comes. This is the best way to live a debt-free life and enjoy frugal living.

Buying organic can keep you healthy and even though it is a bit more expensive, I think it is worth the investment in the long run to actually buy organic now so you don’t spend money on health issues.

These are great tips. I love using Ibotta, it’s saved us so much on groceries. Any tips to cut cost on groceries is the best since that’s where most of our expenses go to. Great article.

So glad you enjoyed 🙂

These are all such great tips! We try hard to live frugally by embracing a homesteading lifestyle. We’ve saved a ton on groceries by growing our own and selling to others. We’re also busy working hard on our homestead goals to really go out and shop. Thanks for this post!

That sounds awesome Diana. Thank you for sharing!

Great tips to save a bunch! Thanks. 🙂

So glad you enjoyed Kim! 🙂

Consolidating trips when you run errands can reduce costs. I get paid 56 cents a mile when I have to drive as part of my job duties, so I use that as a guide. A 20 mile round trip adds $11.20 to the cost of an errand. So running for a gallon of milk, it is cheaper to pay $1 more at the convenient mart/gas station 2 miles away than run to the grocery store for example.

We ditched cable tv and get 28 local channels clear over an antenna. Why pay for over 100 channels when we do not watch much television? And we can get the local news free, which is extra on cable or satellite.

We do oil changes on the vehicles at home as well as the mowers, snowblower and tractor. Sharpening blades and changing belts as routine maintenance.

Hubby is the family barber and stylist, I get my locks trimmed every other month and my boys get theirs cut every 3-4 weeks. Zero costs for haircuts and savings on the transportation costs and no waiting. He does great work, I get asked where I take my boys for haircuts as they look so good, and two of my friends stop by to have him cut theirs or sometimes he does it at their house if we are visiting. We were invited to a barbecue at my best friend’s house last Saturday and she asked me to have hubby bring his haircutting shears and stuff as she needs a trim. He did bring his bag and left it in the car. After we ate, my best friend asked if he brought them as we were hanging out on her deck afterwards. He said sure, then went out to get them as she got out a stool to sit on. So he trimmed her hair as we chatted and had some wine coolers. As he was almost finished , one of her friends pulled her extremely long ponytail around from her back, was looking at her ends and stated she really needed a trim as well. i think we were all quite surprised she said that. Hubby told her that being her hair was so long, he would need her to stand to trim her hair that was long enough to sit on. She said ok, and being her ends were really uneven and had some straggly long pieces, he told her that he would have to take at least five inches off the long pieces to get it even across the back. She said go ahead, it had been over two years since she last had it cut. He trimmed her hair as we all watched intently, it looked so much better after he finished, of course a couple other of the ladies thought he should have cut off a lot more, but my guy is good, not scissor happy, he ignored the remarks and she thanked him afterwards. I believe in being frugal, but going over two years without a trim would be way too long for me. But I think I have it good when not only my friends, but their friends want my hubby to cut their hair. I joked with him that he had a new client. He said yup, she will want one in another two years.

Usually gatherings with friends consist of everyone deciding who brings what of food, and BYOB so it is not all dumped on the hostess to provide everything. We prefer that over the high costs of the restaurant food and drinks. And playing board games during the colder months or horseshoes, badminton, bean toss and other yard games in the warmer weather is cheap fun. My family always had a big picnic in August where we did burgers, chicken, clams, corn on the cob, salads and desserts and a birthday cake for my grandma. So frugal is not new.

Wow! Thank you for all these amazing frugal tips Carolyn! So glad to have you here 🙂

Vacationing in the off-season is an amazing savings. The library is also great. My wife and I do many of these, and that allowed us to retire very early. I’ll have to check out some of the cash back options! The receipt scanning sounds easy. Thank you for the post.

Earn miles or points upon purchasing and then redeem for goods and money are also the common ways of saving money.

Great tip! We love using credit card points as well!