Why Am I Poor? How to Stop Being Broke (fast)

Do you hate feeling broke or ask, “Why am I poor?” Well, you’re not alone.

While some don’t make enough to pay for their basic necessities, others maintain poor spending habits that keep them in debt. In 2018, the American household debt hit a record $13.21 trillion [source]. That’s a lot of zeros! To break the debt cycle, you have to develop positive money habits. So, if you’re tired of saying “I hate being poor”, here are 35 top tips to stop being broke.

Why Am I Poor? Top 35 Tips to Stop Being Broke

Habit #1. Earn Cash Back on Your Everyday Purchases

Wouldn’t it be nice to earn Cash Back on your everyday purchases? Well now you can. Cash back sites and apps are giving consumers more and more opportunities to earn free money on the items they already buy. Sign up for these sites and apps to start earning free money on autopilot.

1. Shop and Dine Out to Earn *Easy* Cash

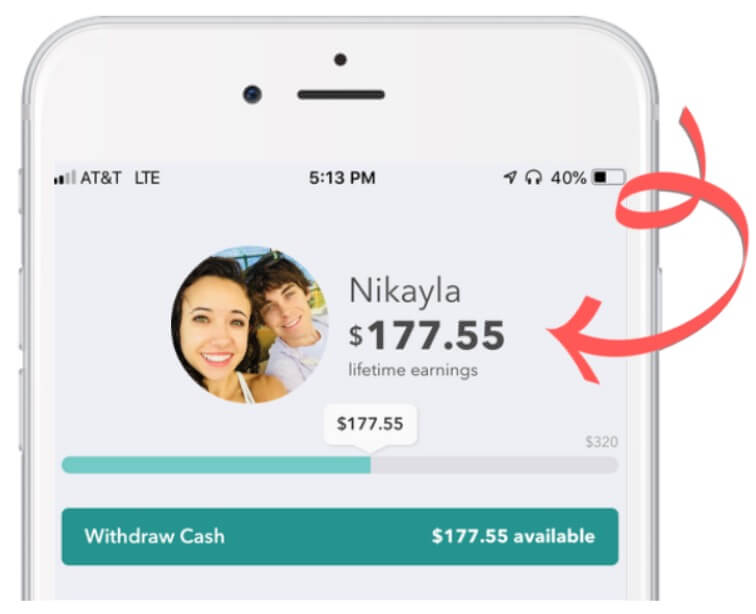

Dosh is a mobile app (iOS and Android) that turns your debit or credit card into a money making machine! Simply link your most used cards to the app and start earning up to 10% cash back on purchases at over 1,000 stores and restaurants. Here’s a couple of our favorites:

Every time you swipe your card, free money is loaded into your account *automatically* in the background!

The only time you have to open the app is to cash out that sweet (effortlessly earned) money straight to your bank account OR PayPal.

You can also get $5 cash when your friends and family link a verified card.

Related: Dosh App Review + In-depth look into their safety/security features

2. Earn Cash From Every Receipts

If you want to earn real cash on your receipts from almost any retailer, start using the CoinOut app (as seen on Shark Tank). All you need to do is take a photo of your receipts and CoinOut will give you randomized rewards.

Additionally, CoinOut surprises users with fun bonuses and extra cash back opportunities every week!

How does it pay? Well, CoinOut pays in the form of real hard cash (i.e. PayPal or Bank deposits) or you can cash out in the form of Amazon Gift Cards!

Need some proof? Check out the last PayPal deposit CoinOut sent us!

Download CoinOut to start earning Money directly to your bank or PayPal account.

3. Get a Big Fat Check for Your Shopping Habits

Get up to 40% cash back when you shop at 2,500 stores using Rakuten (formerly Ebates). Each quarter, Rakuten will send your cash back rewards in the form of a “Big Fat Check”or money transferred to your PayPal account.

You don’t even have to request your cash back payment—Ebates sends payment every three months.

Sign up for an Rakuten account today and earn a $10 Bonus

Also See: Is Ebates Legit? Full Review + How It Works!

Free Workshop – Join our free Simplify Money Workshop

The *only* way to save money is to spend less than you earn. That means you need to decrease your expenses or increase your income.

We want to help you do both.

Join our FREE Simplify Money Workshop to learn the fundamentals of growing wealth. Because when you can spend less than you earn, your money has no choice but to grow. You will build your savings and pay down debt.

What’s more? We’ve got a bunch of free money-hacks to share with you:

- Hacks to lower your monthly bills

- Hacks to spend less on debt

- Hacks to start investing

- Hacks to increase your income by $20/month (with no extra effort)

This workshop has everything you need to accomplish the cardinal rule of personal finance: keep your income over your expenses.

Join our free 5-day Simplify Money Workshop, and start growing your wealth today.

Habit #2: Stop Letting Trips to the Grocery Drain Your Bank Account

If you want to stop being poor, start by reviewing your grocery shopping habits. If you’ve ever gone to the store hungry or forgotten your shopping list, you might have walked out with an astronomical bill. Here are a few ways to live cheap and cut costly grocery trips.

4. Get Free Money Every Time You Grocery Shop

If you enjoy earning free money, Ibotta pays you $5 every time you go grocery shopping.

Ibotta is a free mobile app (iOS and Android) that gives you cash back on your in-store and mobile purchases. You can get rebates on the items you already buy such as milk, eggs, and more.

Just snap a photo of your receipt and your Ibotta account automatically updates with a cash back reward. You can redeem your free money in the form of a free Amazon gift card, Visa gift card, your favorite restaurant’s gift card, or PayPal cash.

Who doesn’t like free money?

Want to hear even more ways Ibotta can save you money? Check out our Ibotta explainer video, here!

Download the Ibotta app and instantly earn a $20 gift card for simply trying it out.

Related: Want to read more about Ibotta? Check out our updated Ibotta app review!

5. Stop Buying Water Bottles

Did you know the average American spends $100 a year on bottled water? [source] Why spend money on bottled water when you have plenty of water at your fingertips?

If you buy a pack of water every grocery visit, you could save hundreds of dollars just by switching to a filtered water. Additionally, if you indulge in juice or other sugary beverages, you’re not only wasting your money, you’re wasting precious calories.

Do your health and your pocketbook a favor and switch to filter water only.

Also See: 34 Simple Frugal Living Tips– Save $1000’s Every Month

6. Swap an Adult Beverage for a Healthy Alternative

If you enjoy an adult beverage from time to time and are still asking “why am I broke”—alcohol could be the culprit.

According to the Bureau of Labor Statistics, U.S. Department of Labor, the average American spends 1% of their annual income on alcoholic beverages [source]. If the average American makes about $46,800, they are spending $468 a year on alcohol.

So, instead of indulging in a fancy glass of wine at dinner, try sticking to a non-alcoholic alternative like filtered water.

Habit #3: Cut Recurring Charges You Forgot About

From Pandora to Netflix, recurring subscription services can add up. It’s easy to forget about them when they’re directly paid from your bank account.

About 84% of consumers in a recent survey underestimated the dollar amount they spent on subscription services every month. Consumers estimated that they spent about $111 per month, when in actuality they spent $237. [source]

If you’re like most consumers, you’re paying for services you don’t need or have forgotten about. So, carve out some time and review all your expenses. Then, cut the ones you no longer have a use for.

7. Get Rid of Unused Subscriptions:

If you don’t want to take the time to cancel your subscriptions or negotiate lower service fees, try letting a free app do it for you.

Apps like the Trim app can help you cancel subscriptions, negotiate lower cable bills, help you find better insurance premiums, and more.

Please note that Trim takes their payment immediately. For example, if Trim saves you $10/month, they will request their 33% fee ($40) right away. But you keep 100% of the savings after that.

Getting ripped off by your cable provider? Download Trim to take the hassle out of lowering your cable service.

Also See: How to Lower Your Bills with Negotiating Services

Habit #4: Start a Side Hustle

8. Love to Educate K-8 Students, But You Just Don’t Want a Traditional Teaching Position? BookNook is for You

Do you have a passion for helping K-8 students succeed and want to make a difference in their lives, but you just could not commit to accepting a traditional teaching role?

If this is you, then you already know how frustrating it is to want to be a difference maker for students facing a variety of challenges, whether academic, economic, racial, or social. You just can’t ignore that desire burning within you.

There’s good news: You can do all those things to help students thrive and succeed on a flexible schedule in front of a computer from the comfort of your home.

BookNook is an online tutoring service dedicated to helping students from diverse racial, cultural, and economic backgrounds, and they are looking for tutors who are passionate about working with all kinds of learners.

The application process is simple. Apply online in 10 minutes. If you fit what BookNook is looking for, then they will send you some additional questions to answer via video. If they decide to add you as a tutor on an independent contractor basis, you will know in about five days.

To be considered as an online tutor, you will need 3+ years teaching or tutoring, or 1 year teaching or tutoring and at least a bachelor’s degree, or 1 year teaching or tutoring and current enrollment in a teaching credential program.

Just because you choose not to be a traditional educator, don’t let your passion for education go unused. Use your gift of helping others and apply to become an online tutor with BookNook. Start making positive impacts on students’ lives again.

9. Find a Side-Hustle with Steady

Side hustles help you earn cash for doing the things you enjoy. Now is the perfect time to begin looking for a side gig. Use the Steady App to find a job that fits your personality and skill set. What hobbies do you enjoy that could turn a profit? Take a moment to write them down and research how to how to make money doing them.

There are many ways you can make money using the skills and talents you already have. Download the Steady App to find a side-gig that is perfect for you.

- Related: How to Make $200 Every Day Part-Time

Habit #5: Get Healthy

Did you know the average 65 year old retired couple needs about $280,000 just to cover medical costs in retirement? [source] You may think retirement is far off, but there are things you can start doing today to help cut this costs.

For starters, begin working on your health. The healthier you are, the less you may have to visit the doctor, reducing your medical bill costs. By eating right and taking care of your body, you can keep yourself from being poor. If you need an extra boost of motivation, there are some apps that will pay you for your efforts.

10. Step Your Way into Endless Rewards

Sweatcoin is a new activity tracker that lets you earn Digital Currency for the steps you take. Basically, you get paid for moving and exercising more.

You can use your digital currency in the Sweatcoins marketplace. Start taking regular walks for your health, and start spending your sweatcoins on jewelry, watches, headphones, and more.

If you’re ready to get in shape and like free stuff, download Sweatcoin and start stepping.

11. Complete Wellness Challenges for Cash Prizes

Who doesn’t enjoy a little friendly competition? HealthyWage gives you and your friends the opportunity to earn cash prizes for completing wellness challenges, making a personal weight loss best, gathering your friends for weight loss challenges, or competing in a corporate wellness program.

If you’re looking for a way to up the weight loss ante, HealthyWage can help you get there. Win thousands of dollars for taking care of your health and wellness.

Join the next HealthyWage team challenge for your chance to win $10,000.

12. Try a Bidet

The average family spends over $100/year on toilet paper. Why waste this money when there is solution thats cheaper, benefits the environment, and is significantly more sanitary.

Use a Bidet. Europeans use them. It’s time for us to get on board. Here’s a couple of options on Amazon right now:

– Handheld Bidet– This one is the #1 Best Seller on Amazon

– Easy-Install Bidet– This is more like a typical bidet you attach to your toilet seat. It has over 1,700 4.5 Star Reviews!

Habit #6: Replace Your Shopping Addiction with a Less Expensive Hobby

Want to know how to stop being poor? Try replacing your online shopping addition with a less expensive hobby.

With free shipping and handling offers, online shopping is the preferred shopping method for many. The convenience of browsing your favorite retail sites in your pajamas, makes purchasing online a hard addiction to break.

Instead of browsing the latest deals and discounts, start reading eBooks or researching free activities you can do in your community. There are many alternative hobbies that can keep you busy without breaking the bank.

Here are a few other suggestions to aid you in cutting back on your online shopping habit.

13. Remove Your Save Credit Information

Retailers save your credit information to simplify the buying process. Disconnecting your credit card information from your favorite retail sites will give you more time to think about your purchase before you hit “submit”.

The effort it takes to find your wallet, may be just what you need to skip unnecessary purchases.

Related: You’re missing out on cash back! Compare your card to the ‘Best Cash Back Credit Cards of 2022’

14. Unsubscribe From Your Favorite Retail Newsletters and Promotional Emails

Retailers do their best to send you deal and discount alerts to seduce you back to their site. Unsubscribing from their newsletters and promotions will help you avoid impulse buys.

- Also See: 6 Habits of People Who Never Overspend

15. Venture Outside for Fresh Air and Exercise

Exercising is a great activity to help you avoid staying poor. Instead of spending hours on the internet, head outdoors for some hiking.

Trying a new sport or a running club, will not only keep more money in your pocket, it can help you make new friends.

Habit #7: Avoid Late Night Drive-Thrus

You may think you’re saving money by hitting up the “cheap” drive-thrus, but, in fact, you’re actually wasting more money than if you were to eat at home.

The July 2017 Consumer Price Index reported that the cost of dining out has risen more than 2%, on average, from 2016 to 2017. On the other hand, groceries have maintained their cost and are relatively affordable. [source]

Here are some other alternatives that can help you cut food cost and prep time.

16. Meal-Prep for Fast Healthy Food

Weekly meal plan services have become a popular and affordable option for consumers. $5 Meal Plan has made meal planning as simple as possible.

For $5 a month, they will send a meal plan where every meal will cost $2 per person and sometimes even less.

17. Order Your Way to Healthier Living

If you don’t like the hassle of going to the grocery store every week, try ordering your vitamins, supplements, and healthy foods online with Vitacost.

Vitacost offers up to a 50% savings on healthy retail products that you want and need. Also, you can enjoy Free shipping on all order over $49.

If you want to save an additional 20% on all of your health products, join Vitacost today!

18. Save Money on Household Items and Food Purchases

If you thought Overstock was just for household items and furniture, think again. Overstock lets you save on everything from gourmet cheese products to juicy steaks.

If you want healthy and inexpensive food delivered right to your front door, try shopping on Overstock.

Habit #8: Spend Money With a Budget

One of the best ways to avoid being poor, is to make and stick to a budget. Developing and sticking to a budget may seem mundane and restrictive, but it can be one of the best ways to get your spending under control.

There are many different budgeting strategies that can fit your lifestyle and spending habits. One of the more popular methods is using the 50/30/20 rule. This means you will use 50% of your income on necessities, 30% on luxuries, and 20% on savings.

Using this method will help you organize your finances. It can also help you determine where you may be overextending your income.

Here are some other budgeting tips that can help you avoid being broke.

19. Live Below Your Means

Many Americans struggle to love within their means, not because they don’t make enough, but because they spend more than they earn. According to Bankrate, most Americans don’t have enough to cover a $1,000 unexpected expense. [source]

To avoid going into debt due to an unexpected expense, you will need to review your income and expenses. Review you budget and make sure your spending less than you earn. If you’re spending more than you earn, you may need to cut your expenses.

Also See: Lower My Bills: Best Bill Negotiators

20. Track Spending Habits

If you don’t know where your money is going, how can you expect to make adjustments. In order quit your poor spending habits, you will need to track your purchases.

Start by reviewing your bank and credit card statements for a few months. This will help you check where your money is going and determine your poor money habits.

Once you discover the spending habits that are keeping you poor, you can begin to making adjustments.

For example, if you discover you’re visiting Starbuck 5 times a week, try cutting your visits to once a week.

21. Make Investing Part of Your Overall Financial Plan

Earning more income, cutting expenses, and saving more money can only go so far when it comes to building wealth and saying goodbye to being broke. At some point, you need to invest a portion of your income to provide long-term financial gains. While there are ups and downs in the stock market, generally a long horizon the market will be higher. That’s why so many people invest.

You have available several avenues to invest. Many workers’ first introduction to investing is with a 401(k) retirement account offered by their employers. There are apps to get you investing, and there are financial advisors. The key is to get started as early as possible and be consistent while understanding there is a risk.

Mainvest Provides Regular Folks Chance to Invest in Local Companies

The American Dream embraces many ideals, like building your own successful business. Not everyone can risk what it takes to be a business owner, but you can be part of a winning team that invests in local businesses, helping them launch or expand.

Mainvest is a crowdfunding platform that joins small- to medium-businesses and willing investors. For many companies, all it takes is $100 to become an investor. Like all investments, there are risks. But with Mainvest, they vet businesses to ensure they have a high probability of returning money to investors.

Sign up with Mainvest and invest in projects important to you for as little as $100.

22. Automate Your Savings

Automating your savings can help you drop the temptation to skip a contribution or use your savings for other purposes. To set up automatic contributions, visit your bank or financial institution to set up an automatic bank transfer from your checking to savings account.

Even if you have to start with a small contribution, the goals is to simply start. You can increase your contribution amount, as you become more comfortable working within a budget.

Alright, those are the easiest ways to stop being broke and start saving money!

Save More Money! Read These Next:

- 9 Dave Ramsey Tips You’ll Wish You Knew Sooner

- 5 Things Frugal People Never Buy (and you shouldn’t either)

- 7 Bad Habits That Are Keeping Your Poor Without Realizing It

Save Money At Your Favorite Stores:

- 9 Ways to Save Money at Aldi

- 10+ Things to Always Buy At Dollar Tree (+ what to avoid)

- 6 Must-Try Walmart Shopping Hacks

Want to save this article for later? Pin it here.

Be sure to follow us on Pinterest for more *achievable* money saving tips!

Many good tips, but only if you’re in the U.S! And, yes, I most definitely buy bottled water, the stuff that comes out of our taps is full of limescale and chlorine, I’m not touching it! You didn’t mention growing your own vegs, that’s a real saver!

Thanks for the tip Rachel!

Great post! Food is one of the biggest expenses for most people so finding ways to cut costs is crucial to living a frugal life!

So glad you enjoyed Michael!

Great post! Extremely helpful!

So glad you enjoyed Robin!

all ideas are awesome and sure shot to work

Hhhmmmm….water-only diet! I could actually try that.

awesome ideas! thank you for sharing this.from:philippines

Thanks you Raquel! 🙂

Awesome ideas! Thank you sooo much? I am going to join all those places so you get the credit!

Thank you so much Shelly! You are too kind. So glad you enjoyed 🙂

Hi Ashley, such an amazing ideas to start a blog on different niches. Really an useful post with clean and clear details. Thanks for sharing this post. Keep sharing.

So glad to have you here Smith! 🙂

Am glad I saw this… wondering if I can do all these from Nigeria.. Africa

Awesome blog post with full of detailed information! Thanks for the tips! 🙂

So glad you enjoyed Kirin:)